Best Credit Cards in India 2025 – Zero Annual Fee & High Cashback Offer

When it comes to managing personal finances smartly, credit cards have become one of the most powerful tools in India. But with so many cards available, choosing the right one can be confusing. In 2025, Indian banks and fintech companies have introduced several credit cards that not only offer zero annual fees but also come with attractive cashback and rewards. Whether you’re shopping online, booking tickets, or simply managing monthly expenses, using the right credit card can save you a lot of money and even earn rewards in the process.

In this article, we’ll break down some of the best credit cards in India for 2025 that offer maximum cashback, zero joining or annual fees, and amazing offers for online and offline purchases. If you’ve been thinking of applying for a credit card or switching to a better one, this guide is made for you.

Why Choose a Credit Card with Zero Annual Fee?

A zero annual fee credit card means you don’t have to pay any charges yearly to keep the card active. These cards are perfect for first-time users, students, or even salaried professionals who want to keep their spending in check while enjoying benefits like cashback, reward points, fuel surcharge waivers, and EMI facilities. In 2025, most Indian banks now provide such options without hidden fees or complicated terms.

Key Features to Look For in 2025

Before choosing a credit card, check for these features to get maximum benefit:

- Zero Joining and Annual Fees: No extra charges yearly.

- High Cashback Offers: Especially on groceries, fuel, travel, and online shopping.

- Fuel Surcharge Waiver: Saves money on petrol or diesel expenses.

- EMI Conversion: Useful for large purchases.

- Reward Points: Can be redeemed for vouchers, flights, or shopping.

- No Cost EMI for Electronics or Mobiles: Many cards now offer this during Flipkart and Amazon sales.

Top 5 Credit Cards in India with Zero Annual Fee & Great Cashback (2025)

Let’s look at some of the most user-friendly and rewarding credit cards this year:

1. Amazon Pay ICICI Credit Card

One of the most popular cards for online shoppers, especially Amazon users. This card has:

- No Annual Fee Forever

- 5% cashback for Amazon Prime users, 3% for non-prime members.

- 1% cashback on all offline spends

- Fuel surcharge waiver at petrol pumps.

- Accepted worldwide with Visa platform.

This card is perfect for anyone who shops regularly on Amazon, pays utility bills online, or even buys groceries.

2. Flipkart Axis Bank Credit Card

If you prefer Flipkart over Amazon, this one is ideal for you. Although it has a joining fee of ₹500, it often comes with welcome vouchers and the annual fee is waived off if you spend ₹2 lakhs/year.

- 5% cashback on Flipkart & Myntra

- 4% cashback on Swiggy, Uber, PVR

- 1.5% cashback on all other spends

- Free lounge access at domestic airports.

Considering the cashback rates, it’s one of the most rewarding cards of 2025.

3. IDFC FIRST Millennia Credit Card

If you’re a young professional or college student, the IDFC FIRST Millennia card is a solid option.

- Lifetime Free Card – No annual fee ever.

- 3x to 10x reward points on all spends.

- Zero interest on cash withdrawal for 48 days

- Fuel surcharge waiver up to ₹200/month

- Easy EMI options and free movie vouchers.

It’s one of the few credit cards in India that offers zero-fee with premium-like benefits.

4. HSBC Cashback Credit Card

HSBC entered strong into the cashback space with this card in 2025.

- No joining fee and 1st year free annual fee

- 1.5% cashback on all online spends

- 1% cashback on all other spends

- Cashback is auto-adjusted to your next bill.

- Ideal for salaried professionals or frequent online buyers.

Their online application process is smooth and fast, with instant approval for eligible users.

5. SBI SimplyCLICK Credit Card

Although SBI charges a small joining fee, the benefits outweigh the cost, especially if you spend online.

- 10x reward points on online spends via Amazon, Cleartrip, BookMyShow, etc.

- Annual fee waived if you spend ₹1 lakh/year

- Welcome e-voucher worth ₹500

- Fuel surcharge waiver and EMI options available.

SBI’s wide acceptance and excellent customer support make this one of the best entry-level cards for digital spenders.

Tips to Increase Credit Score Using Credit Cards

Using credit cards wisely can actually improve your CIBIL score, which is very important if you want a personal loan or home loan in the future. Here’s how:

- Always pay your full bill before the due date.

- Keep your credit utilization below 30%.

- Don’t apply for too many cards at once.

- Check your statement monthly for unauthorized charges.

A good credit score can get you lower interest loans, better EMI offers, and faster approvals in 2025.

Final Words

Credit cards are no longer just about borrowing money. In 2025, they’ve become smart financial tools that reward your regular expenses. Whether you’re shopping online, booking travel tickets, paying utility bills, or even ordering food, the right credit card can give you cashbacks and benefits without any extra charges.

If you’re someone who wants to save more every month while building a good credit profile, it’s the right time to apply for a zero annual fee, high cashback credit card. Just remember to use it responsibly, pay your dues on time, and enjoy the extra savings every month.

Still confused? Start with Amazon Pay ICICI or IDFC FIRST Millennia – both are safe, free, and come with great features for 2025!

Font link

DOWNLOAD

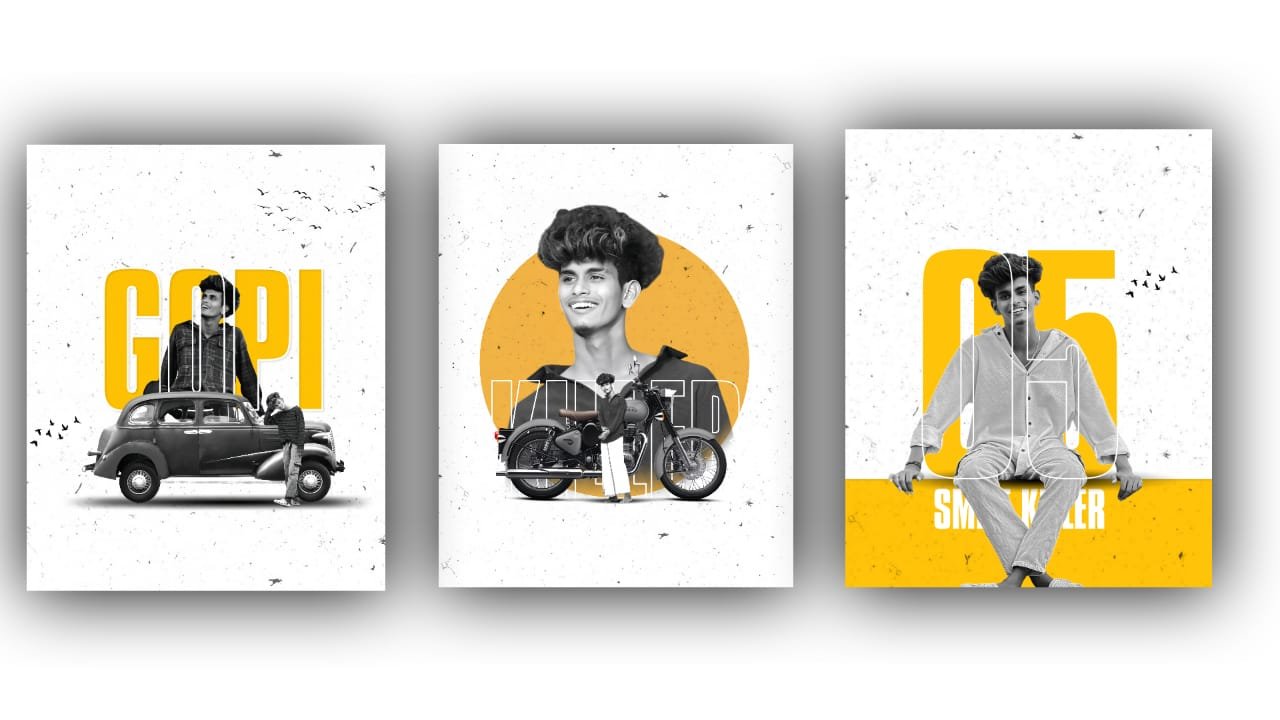

Photo project