In today’s fast-changing economic landscape, choosing the right investment options is essential for anyone looking to grow wealth and achieve long-term financial stability. The year 2025 brings new opportunities and evolving market trends, making it crucial for investors to stay updated on high-yield and secure investment choices. When planning your investment strategy, it’s important to focus on a mix of safety, returns, liquidity, and tax benefits to maximize your earnings while minimizing risk. One of the safest and most popular investment avenues remains fixed deposits (FDs). In 2025, several banks and non-banking financial companies (NBFCs) are offering competitive FD interest rates, especially for senior citizens. FDs provide guaranteed returns, capital protection, and flexible tenure options. However, while they are safe, they may not offer the highest returns compared to other market-linked investments. For those willing to take moderate risks, mutual funds continue to be a top choice.

Equity mutual funds, particularly large-cap and flexi-cap funds, have the potential to deliver impressive returns over the long term. In 2025, systematic investment plans (SIPs) remain a preferred method to invest in mutual funds as they help average out market volatility. Debt mutual funds are another option for investors seeking lower risk with better returns than traditional savings accounts. Stock market investments are ideal for investors with a higher risk appetite and a good understanding of market trends. Investing in blue-chip stocks, emerging sector stocks, and companies with strong fundamentals can yield significant returns. In 2025, sectors like renewable energy, electric vehicles, artificial intelligence, and healthcare are showing promising growth potential. However, stock investments require constant monitoring and market awareness to avoid losses. Real estate investment continues to be a popular choice, especially in rapidly growing urban areas. In 2025, investing in residential properties in developing cities and commercial spaces in business hubs is expected to provide attractive appreciation in value.

Additionally, real estate investment trusts (REITs) offer an opportunity to earn rental income and benefit from property value appreciation without the need to directly own and manage physical property. Gold remains a time-tested asset for wealth preservation, particularly in uncertain economic conditions. Apart from physical gold, investors can choose digital gold, gold ETFs, and sovereign gold bonds (SGBs) for safer and more convenient exposure to the precious metal. SGBs offer the added advantage of fixed interest income along with potential capital appreciation. For those seeking government-backed, low-risk investment schemes, Public Provident Fund (PPF) and National Savings Certificate (NSC) remain highly attractive. PPF offers tax-free returns with a 15-year maturity period, while NSC provides fixed interest rates with guaranteed returns. The Sukanya Samriddhi Yojana (SSY) is another excellent scheme for parents aiming to secure their daughter’s future. In 2025, Unit Linked Insurance Plans (ULIPs) are gaining popularity among investors who want both life insurance coverage and market-linked returns. ULIPs allow investors to choose between equity, debt, or balanced funds, depending on their risk profile. For those interested in alternative investments, cryptocurrency remains a high-risk, high-reward option. In 2025,

regulatory clarity in many countries is encouraging more investors to consider cryptocurrencies like Bitcoin, Ethereum, and emerging altcoins. However, due to their volatility, cryptocurrencies should form only a small portion of a diversified portfolio. Peer-to-peer lending platforms are another modern investment choice that offers attractive returns by lending money directly to borrowers, but they also carry higher default risks. Diversification is key to maximizing returns while safeguarding your investments in 2025. A balanced portfolio that includes a mix of safe instruments like FDs, PPF, and gold, along with growth-oriented options like mutual funds, stocks, and real estate, can help you achieve both short-term and long-term financial goals. Additionally, investors should stay informed about market conditions, government policies, and global economic trends to make timely adjustments to their portfolios. Using professional financial advice and leveraging digital investment platforms can make the process easier and more efficient. Finally, tax planning should be an integral part of your investment strategy.

Opt for instruments that provide tax benefits under Sections 80C, 80D, and 10(10D) of the Income Tax Act to maximize post-tax returns. In conclusion, 2025 offers a wide range of investment opportunities for all types of investors, from conservative savers to aggressive risk-takers. By understanding your financial goals, risk tolerance, and investment horizon, and by diversifying across various asset classes, you can make smart investment decisions that lead to wealth creation, financial security, and peace of mind.

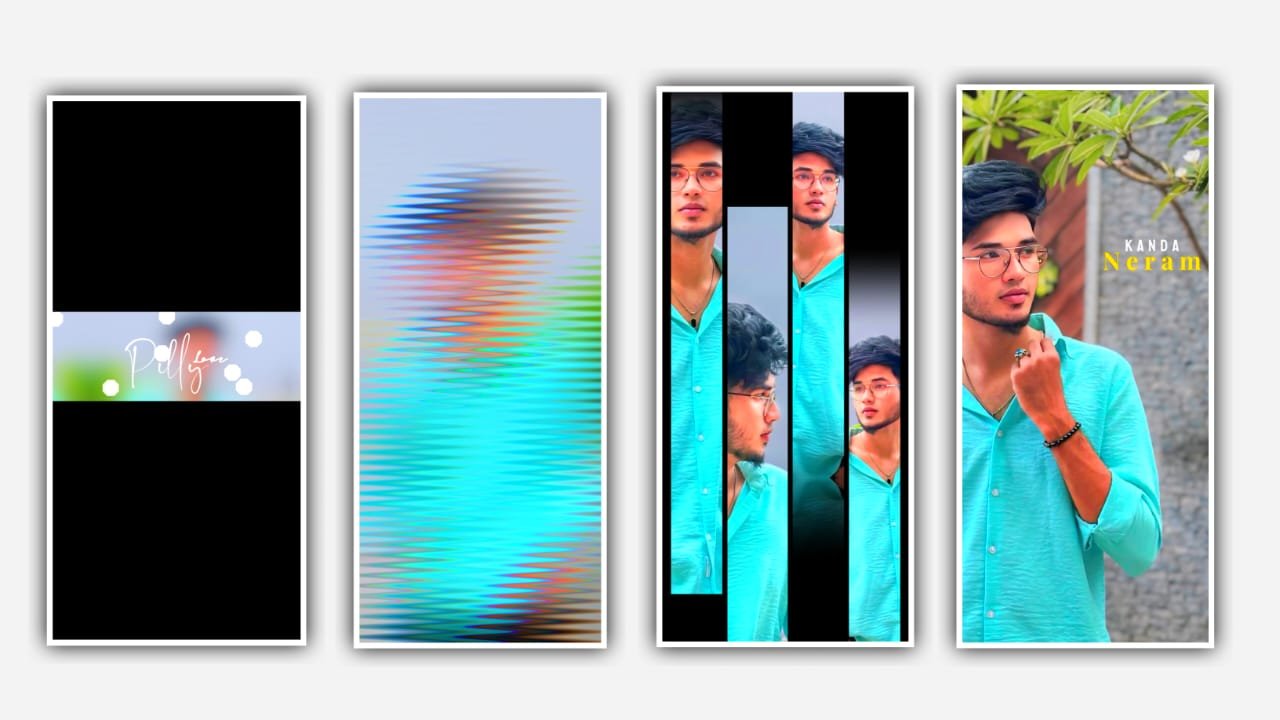

FULL PROJECT

Full project

XML file

DOWNLOAD

Song link