Digital wallets have rapidly become an essential part of everyday financial life, transforming how people store money, make payments, and manage transactions, and in 2025 their role is only expanding as more consumers and businesses shift toward cashless systems. Unlike traditional wallets that hold cash and cards, digital wallets store payment information securely on smartphones, allowing users to make instant payments with just a tap or scan, whether online or offline. Popular platforms like Paytm, Google Pay, PhonePe, Amazon Pay, and international players such as Apple Pay and PayPal have made digital transactions seamless, covering everything from groceries and utility bills to travel bookings and international transfers. One of the biggest advantages of digital wallets is convenience, as they eliminate the need to carry physical cash or multiple cards while ensuring that transactions are completed in seconds with minimal effort. Security is another major benefit, as most wallets integrate encryption, biometric authentication, and tokenization to protect user data, making them safer than carrying cash or swiping cards in vulnerable machines. Digital wallets also integrate with reward systems, offering cashback, discounts, loyalty points, and referral bonuses that add value to every transaction, encouraging users to adopt them as their primary payment method. For businesses, especially small merchants, digital wallets reduce the dependency on card machines and enable instant settlements, while QR codes and UPI integration have made even the smallest roadside vendor part of the digital economy. Beyond payments, wallets are evolving into financial ecosystems, offering services like micro-loans, buy-now-pay-later options, insurance, investments, and even access to mutual funds or gold, making them more versatile than traditional banking apps. Cross-border wallet integration is also gaining traction, enabling travelers to pay in foreign countries without currency exchange hassles, which marks a huge step toward global financial inclusivity. Another key trend in 2025 is the use of digital wallets in contactless wearables like smartwatches and rings, taking convenience to the next level. Governments and regulators are also supporting wallet adoption by promoting cashless initiatives, increasing transaction limits, and ensuring better consumer protection frameworks. For rural areas, digital wallets have opened doors to financial inclusion, allowing people without traditional banking access to participate in the digital economy through smartphones and simple apps. However, challenges such as cybersecurity threats, fraud attempts, and over-dependence on mobile networks remain areas of concern, making awareness and user education essential. Despite these challenges, the future of digital wallets looks extremely strong as they continue to integrate with emerging technologies like blockchain, central bank digital currencies (CBDCs), and AI-driven spending analysis. Ultimately, digital wallets are not just payment tools—they are becoming central hubs for financial management, bridging the gap between banks, fintech, and consumers, while paving the way for a faster, smarter, and more connected cashless future.

Super VPN

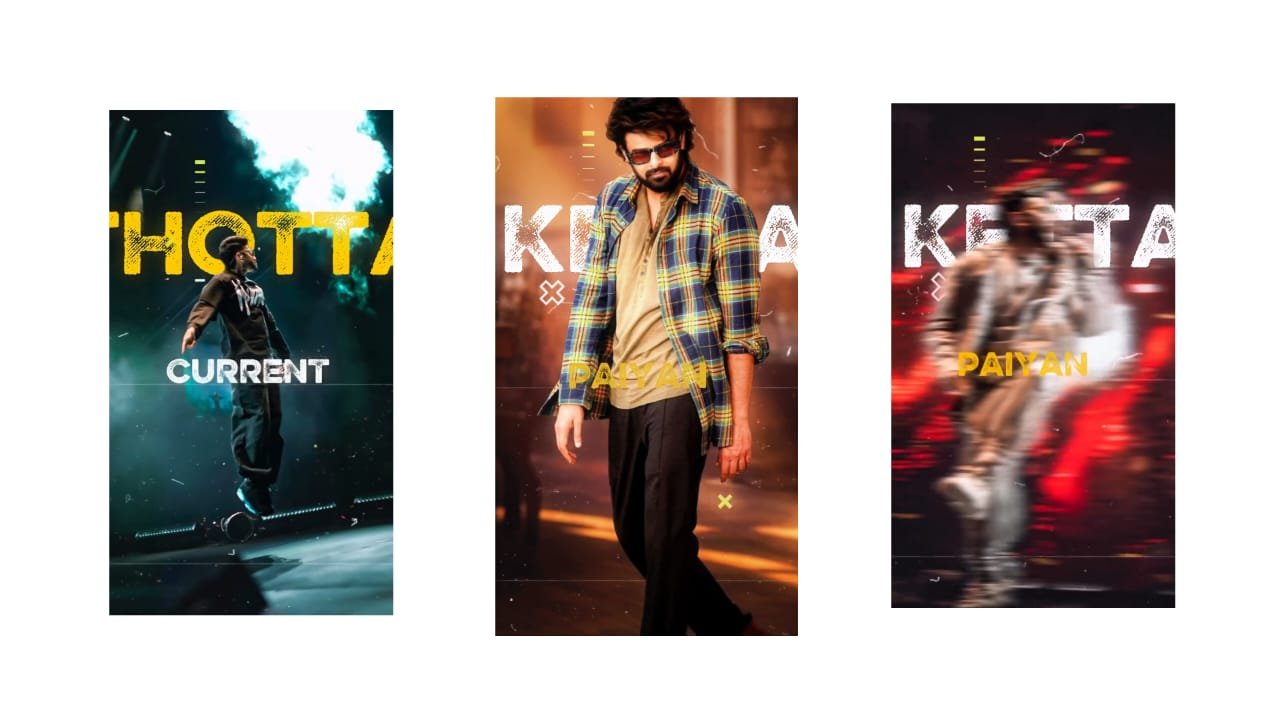

Cap Cut app

Template Link