Term life insurance has become one of the most trusted financial products in India, offering simple yet powerful protection for families against life’s uncertainties by ensuring financial stability in case of the policyholder’s untimely demise. Unlike traditional insurance plans that combine investment with protection, term insurance focuses purely on life cover, making it affordable while offering a significantly higher sum assured compared to the premiums paid. For example, with a small annual premium, one can secure coverage worth crores of rupees, which would be impossible through savings alone, ensuring that dependents can continue their lives without financial struggles. This feature makes term insurance one of the most efficient tools for income replacement, as the payout can be used for day-to-day living expenses, paying off loans, funding children’s education, or even securing retirement for a spouse. One major reason why experts recommend buying term insurance early is affordability—premiums are

lowest when you are younger and healthier, but increase sharply with age or health issues. Modern term plans also provide flexibility, allowing policyholders to choose from various payout options such as lump sum, monthly income, or a mix of both, depending on the family’s financial needs. Additionally, many insurers now offer riders like accidental death benefit, critical illness cover, and disability protection, which enhance the scope of coverage at a minimal additional cost. Another important benefit of term insurance is tax savings under Section 80C and Section 10(10D), where both premiums paid and death benefits are tax-exempt, making it financially rewarding alongside protection. With increasing awareness, term insurance has shifted from being just a product for salaried individuals to also being popular among business owners, self-employed professionals, and even NRIs who want to secure their families in India. Online term plans have further made the process easy, allowing customers to compare, buy, and manage policies digitally at lower

premiums due to reduced agent costs. Insurers are also introducing innovative features like return of premium plans, where policyholders get back all premiums paid if they survive the policy term, combining protection with savings. Many plans even extend coverage till the age of 99 or 100, ensuring lifelong protection if desired. In India, where families often depend on a single breadwinner, term insurance acts as a shield against financial crises caused by loss of income, protecting children’s future and ensuring parents or spouses do not have to compromise their lifestyle. The COVID-19 pandemic highlighted the importance of term insurance, as many families faced unexpected tragedies and those with adequate coverage were able to sustain themselves financially despite emotional losses. While buying term insurance, it is crucial to assess the right coverage amount—experts recommend at least 10 to 15 times of annual income plus liabilities like home loans or education expenses to ensure complete protection. Claim settlement ratio is another key factor, as choosing an insurer with a high settlement record gives confidence that the family’s claim will not be rejected. Premium payment flexibility is also available, with options like monthly, quarterly, or annual modes, as well as single-pay policies for those preferring one-time payments.

With rising financial responsibilities and inflation, term insurance ensures that future goals such as higher education, marriage expenses, or loan repayments are not derailed in case of unforeseen events. Unlike savings or investments that fluctuate, term insurance offers certainty with a guaranteed payout when needed most. Even for homemakers or non-earning members, term insurance can be beneficial as it covers the financial value of their contribution to the household. Ultimately, term insurance is not an expense but a safeguard—a promise that your loved ones will never face financial hardship due to life’s unpredictability. By making it a core part of financial planning, every family can achieve peace of mind, knowing that their future is protected no matter what happens.

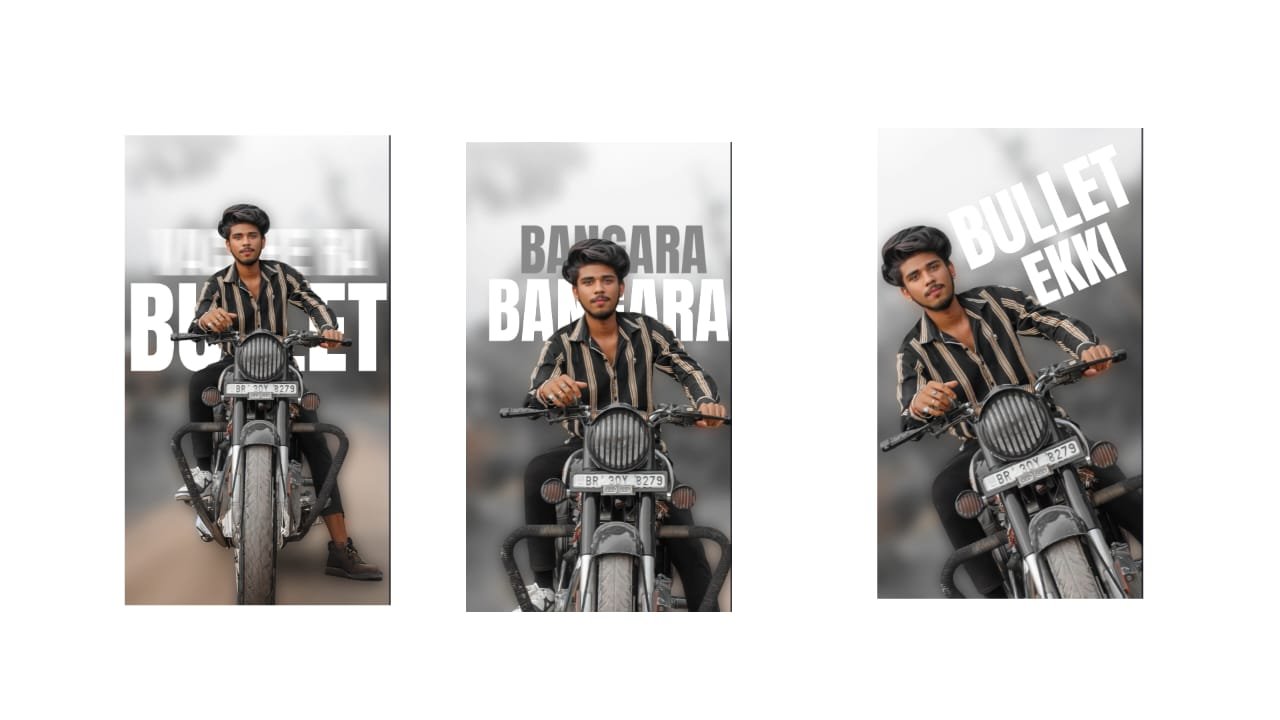

Photo background Remove

Full project

DOWNLOAD

XML file

DOWNLOAD

Song link