In the modern era, where digital technologies dominate everyday life, financial planning has become not only a tool for wealth creation but also a necessity for survival, especially for millennials who are navigating an uncertain economy, rising inflation, and rapidly evolving job markets. Unlike the previous generations that relied heavily on government jobs, pensions, and traditional savings methods like fixed deposits or gold, millennials today face a landscape where self-reliance and proactive planning are the only ways to achieve financial security. One of the key reasons why financial planning is essential for millennials is the growing cost of living, where urban lifestyles, medical expenses, education fees, and housing costs continue to increase faster than average income growth. Without proper planning,

it is easy to fall into the trap of living paycheck to paycheck, using credit cards irresponsibly, and accumulating unmanageable debt. With the right strategies, however, millennials can build wealth, manage risks, and achieve financial independence earlier than ever before. The first step in financial planning is budgeting, where individuals track income, fixed expenses, and discretionary spending to identify areas of improvement. Using mobile apps and fintech platforms, millennials can easily monitor spending patterns, set savings goals, and automate investments. Emergency funds are another critical component, where having three to six months’ worth of expenses parked in a liquid savings account can shield individuals from unexpected events such as job loss or medical emergencies. Beyond savings, investment plays a crucial role, and millennials are uniquely positioned to benefit from compounding due to their young age. By starting early with systematic investment plans in mutual funds, index funds, or even retirement accounts, they can accumulate significant wealth over decades with relatively small monthly contributions. Furthermore, digital tools allow access to robo-advisors, stock market platforms, and investment calculators that simplify decision-making and empower individuals with real-time data. Insurance planning is equally vital,

as term life insurance provides affordable protection for dependents, while health insurance guards against soaring medical costs, ensuring that emergencies do not derail financial goals. Another aspect millennials must prioritize is debt management, where education loans, personal loans, and credit card dues can quickly become overwhelming if not handled wisely. Creating a repayment strategy, focusing on high-interest debt first, and avoiding lifestyle inflation are practical steps to maintain financial health

. Retirement planning may feel distant for millennials, but given the absence of guaranteed pension schemes and increasing life expectancy, it is crucial to begin investing in long-term retirement funds like the National Pension System or Employees’ Provident Fund at the earliest. Tax planning is another area where young professionals can optimize savings legally through deductions under sections such as 80C and 80D, while also learning about exemptions that reduce liability. With the rise of digital banking, Unified Payments Interface (UPI), and mobile wallets, financial transactions have become faster, safer, and more transparent, enabling better control over money flow. Additionally, side hustles, freelancing, and gig work are providing millennials with multiple income streams, which can be strategically allocated toward investments or debt reduction. One of the biggest challenges in the digital age, however, is the temptation of consumerism driven by e-commerce discounts, social media trends, and instant credit availability, which can sabotage financial discipline. Cultivating mindfulness in spending, distinguishing between wants and needs, and aligning purchases with long-term goals are essential to avoid financial stress. Millennials should also embrace financial literacy by reading books, attending webinars, and following credible advisors to strengthen their decision-making skills.

Cybersecurity is another growing concern, and protecting personal financial data through strong passwords, secure banking apps, and awareness of online scams is as important as managing money itself. Ultimately, financial planning is not a one-time task but a continuous process of evaluating goals, adjusting strategies, and staying disciplined despite market fluctuations or lifestyle changes. For millennials, the advantage lies in starting early, leveraging technology, and being open to learning from both successes and mistakes. The sooner they begin planning, the greater their ability to build sustainable wealth, enjoy financial freedom, and handle life’s uncertainties with confidence. In conclusion, financial planning in the digital age is more than just saving or investing; it is about creating a balanced approach that combines protection, growth, and security, ensuring that millennials not only survive but thrive in an economy that demands adaptability and foresight.

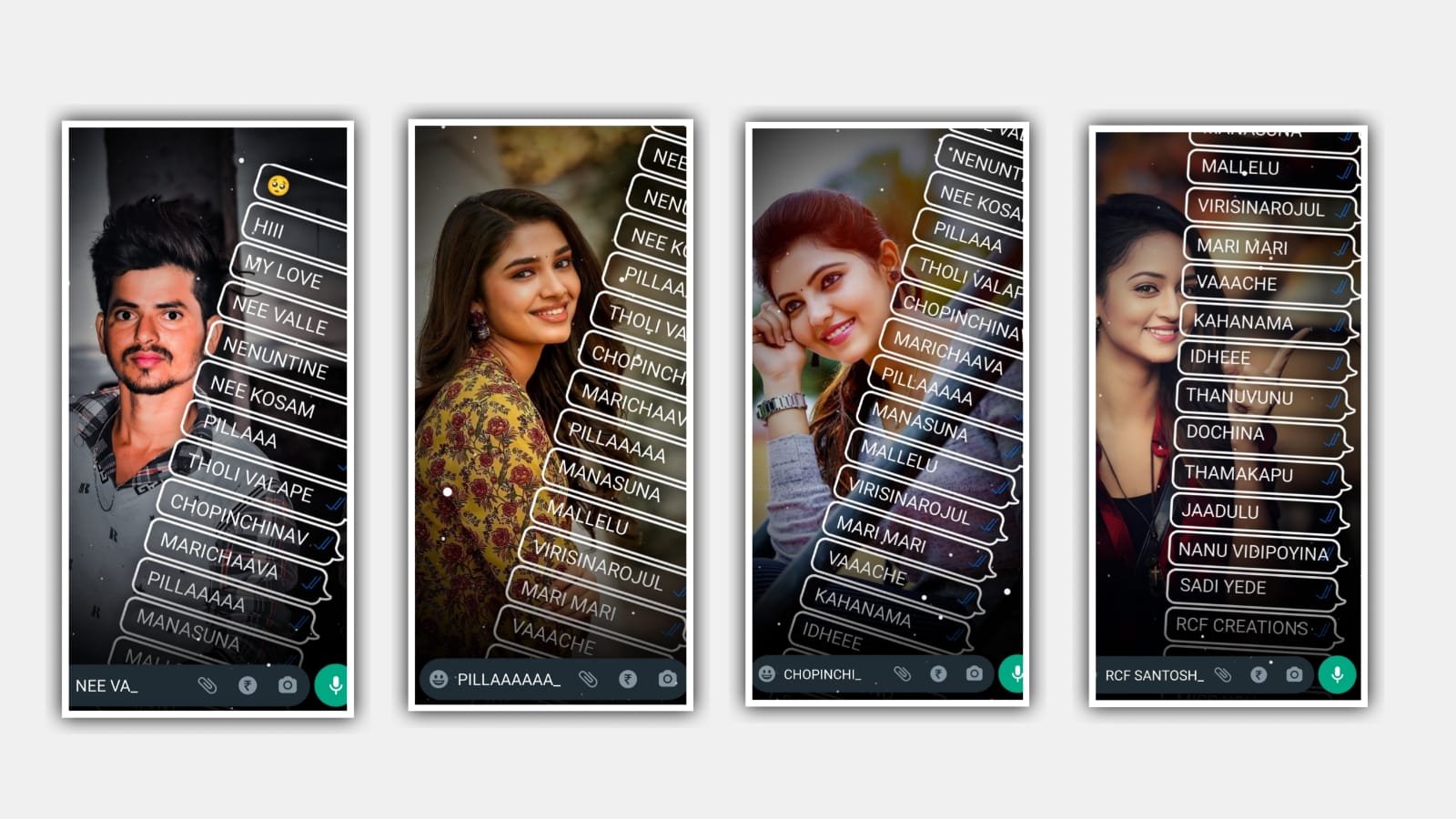

Font link

Full project

XML file

DOWNLOAD

Song link