Gold investment has remained one of the most trusted and reliable ways to preserve and grow wealth for centuries, and in 2025 it continues to be the safest option for individuals and families who want financial security and stability against inflation, currency fluctuations, and economic uncertainties, because unlike paper assets or volatile stock markets, gold has an intrinsic value that never disappears, making it a universally accepted store of wealth, and one of the main reasons people choose gold

investment is that it acts as a hedge against inflation since whenever the cost of living rises, gold prices also tend to increase, thereby protecting the purchasing power of money, and this characteristic makes gold a very attractive long-term investment, especially in developing economies like India where gold is also tied to cultural traditions and considered auspicious, and in 2025 there are multiple ways to invest in gold beyond just buying jewelry, with gold ETFs, digital gold, sovereign gold bonds, and gold mutual funds becoming more popular because they offer the benefit of investing without the burden of storage or security risks, and these modern investment options also provide better liquidity and transparency as prices are directly linked to the global gold market, ensuring fair value, and gold ETFs in particular are gaining traction among young investors who prefer digital platforms and want the flexibility of buying or selling at any time, while sovereign gold bonds issued by the government provide both the benefit of gold appreciation and

additional fixed interest, making them a safe dual-benefit option, and digital gold available through apps like Paytm, PhonePe, and Google Pay has made small ticket gold investment easy even for beginners, since investors can buy as little as one rupee worth of gold and still enjoy market-linked returns, and when comparing gold with other investments like stocks, real estate, or cryptocurrency, gold stands out because of its lower risk and universal acceptance, and although it may not always provide extraordinary short-term returns, its long-term stability makes it ideal for wealth preservation, especially during crises like wars, recessions, or financial collapses, and central banks across the world also continue to stockpile gold reserves in 2025, which further proves its importance as a safe-haven asset, and historically whenever stock markets crash or global uncertainty rises, gold prices surge, showing that it acts as a shield against financial shocks, and for individuals planning their financial portfolio experts recommend allocating at least 10 to 15 percent of total investments into gold to balance risk and ensure diversification, because diversification is one of the smartest financial strategies to minimize losses, and in addition to being an investment, gold also has cultural and

emotional significance especially in countries like India where it is gifted during weddings, festivals, and other special occasions, thus serving both as an asset and a tradition, and with the growing digital revolution, transparency in gold pricing has improved, reducing the risk of fraud and ensuring that customers receive the exact value of their investment, while hallmarking standards have also been made mandatory in many countries to guarantee purity, protecting buyers from low-quality gold, and another major reason for the popularity of gold investment in 2025 is the rise of uncertainty in global markets due to geopolitical tensions, inflationary pressures, and economic slowdowns which are making investors shift towards safer assets, and while cryptocurrencies attracted massive attention in the past few years, their high volatility and regulatory risks are pushing many investors back towards gold as a stable alternative, and experts also predict that as demand for gold rises in countries like China and India, global prices are likely to continue their upward trend in the coming years, making it a profitable long-term asset, and another key advantage is that gold investments are highly liquid because they can be easily sold in the market whenever funds are required, unlike real estate or fixed deposits which may take time to liquidate, and with gold-backed loans becoming easily

available, people can also use their holdings to meet short-term needs without selling the asset, making gold not only an investment but also a financial backup, and looking at future trends, digital innovations like blockchain are expected to make gold trading even safer and more transparent by eliminating middlemen and ensuring secure peer-to-peer transactions, while global financial institutions are also exploring gold-backed digital currencies as a way to combine stability with modern technology, and this could further boost the role of gold in global finance, and for individual investors, the best strategy in 2025 is to combine traditional gold like jewelry or coins with modern options like ETFs and bonds, ensuring both cultural satisfaction and financial growth, and in conclusion gold investment

continues to be the safest and most reliable option for wealth growth in 2025, offering protection against inflation, global uncertainties, and market volatility while also providing cultural and emotional value, and with multiple modern ways to invest and easy access through digital platforms, it has become convenient for every type of investor to include gold in their portfolio, and those who consistently invest in gold over the long term are not only securing their financial stability but also ensuring that their wealth is preserved for future generations, making gold a timeless and unbeatable choice for financial security and prosperity.

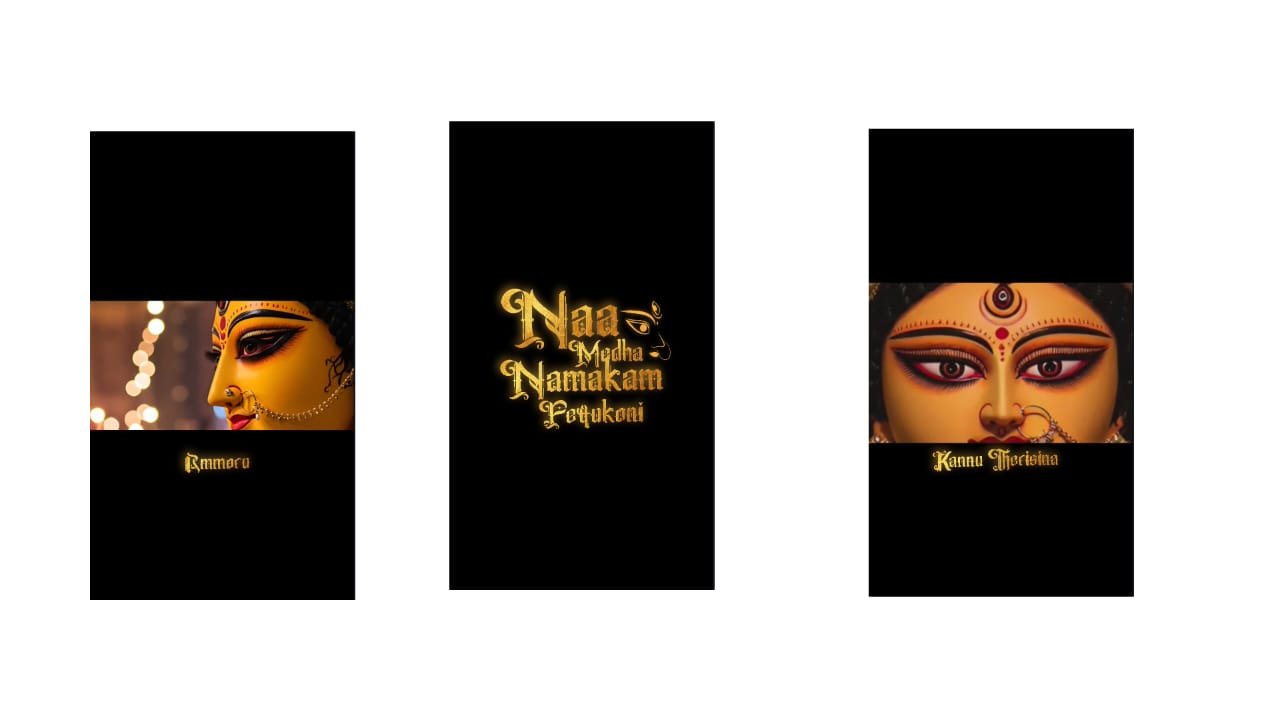

font link

Full project

XML file

Song link