In an age where digital transformation is reshaping every aspect of our lives, the way we handle money, banking, and investments has undergone a dramatic shift, making it essential for individuals to stay updated on the latest tools, platforms, and strategies that ensure both convenience and long-term growth in personal finance. Traditional banking systems, though still reliable, are being rapidly replaced or supplemented by online banking apps, fintech startups, and blockchain-powered platforms that provide faster, cheaper, and more transparent financial solutions, opening doors for people across all demographics to access financial services with just a smartphone and internet connection. Mobile banking has become a cornerstone of this revolution, offering instant account management, seamless fund transfers, bill payments, and real-time transaction alerts, which not only enhance convenience but also strengthen financial control and awareness. Digital wallets such as Google Pay, PhonePe, and Paytm have transformed how consumers pay for goods and services, enabling cashless transactions that are secure, efficient, and widely accepted in both local stores and global

e-commerce platforms, proving especially useful in a post-pandemic world where contactless payments are prioritized. Beyond payments, investment platforms like Zerodha, Groww, Robinhood, and eToro have democratized investing, giving everyday individuals the ability to trade stocks, ETFs, mutual funds, and even cryptocurrencies without the barriers of high fees or extensive paperwork that once discouraged retail participation. The rise of cryptocurrency, particularly Bitcoin and Ethereum, has further disrupted the financial landscape by offering decentralized alternatives to traditional currencies, though they come with risks that demand careful research, strategic allocation, and long-term perspective to avoid losses from volatility. Meanwhile, insurance providers have also adopted digital-first models, allowing users to compare policies, purchase coverage, and file claims online with minimal hassle, making financial protection more accessible than ever before. Personal finance management apps, powered by artificial intelligence, analyze spending patterns, track savings goals, and recommend budgeting improvements, empowering users to make smarter decisions without needing advanced financial literacy. Alongside these advancements, cybersecurity has become a major priority, as protecting sensitive data, preventing phishing scams, and securing digital transactions are crucial responsibilities for anyone navigating online finance, highlighting the need for strong passwords, multi-factor authentication, and awareness of fraud tactics. Additionally, the concept of financial inclusion has gained momentum, as digital platforms extend banking services to rural areas, underserved communities, and emerging markets where traditional banks have limited reach, thereby fostering economic participation and growth at a global scale. Entrepreneurs and freelancers particularly benefit from these changes, as digital tools simplify invoicing, payment collection, and expense tracking, ensuring smoother operations while freeing up time to focus on scaling businesses.

Moreover, passive income opportunities have expanded, with online platforms enabling investments in fractional real estate, peer-to-peer lending, dividend-paying stocks, and even digital products like e-books or courses that generate long-term returns with minimal ongoing effort. Governments and regulatory bodies are also evolving to accommodate these changes, introducing frameworks for fintech companies, cryptocurrency taxation, and digital lending practices to balance innovation with consumer protection.

The increasing integration of artificial intelligence and machine learning in finance is set to redefine the future further, offering predictive analytics for investments, automated customer service through chatbots, and even robo-advisors that provide personalized investment recommendations at a fraction of traditional advisory costs. This technological evolution not only empowers individuals but also challenges them to remain adaptable, continuously learning and updating financial strategies to keep pace with innovation. The younger generation, especially millennials and Gen Z, stand to gain the most from this transformation, as their digital-first mindset aligns naturally with the tools and opportunities being created,

positioning them to achieve financial independence earlier than previous generations if they adopt disciplined and informed practices. However, success in the digital financial world still hinges on timeless principles such as disciplined saving, prudent investing, avoiding unnecessary debt, and focusing on long-term goals rather than short-term gains. As financial ecosystems continue to evolve, those who embrace technology while staying rooted in sound financial habits will not only secure their future but also open doors to wealth creation

opportunities that were once reserved for the elite. In conclusion, the digital era has revolutionized banking, payments, investments, and financial management, creating a world where opportunities are abundant, accessibility is widespread, and growth potential is limitless for those who are prepared to adapt, learn, and strategically act in building their financial future.

Prompt 1

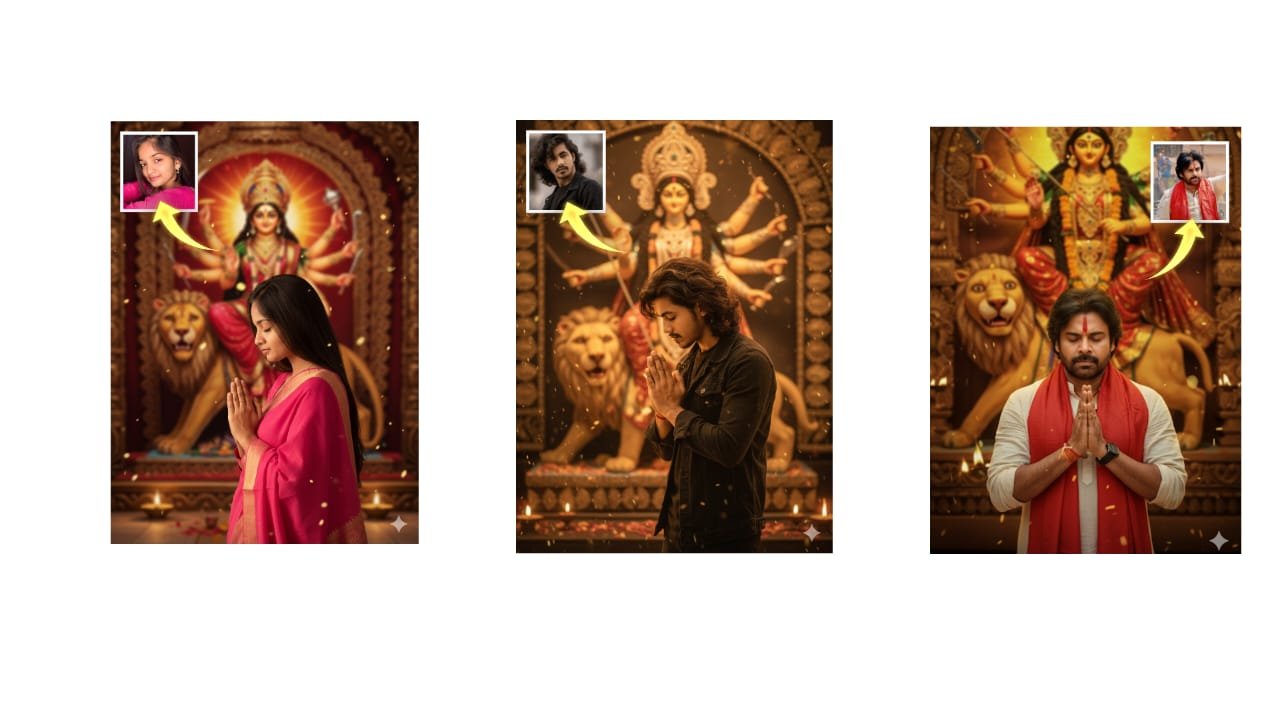

create A beautiful festive portrait of a Uploaded image same Praying to God She stands in front of a grand idol of Goddess Durga with multiple arms, shown in the background with a divine blur effect. Same dress fill the atmosphere, symbolizing devotion, energy, and celebration. The scene is vibrant, spiritual, and cinematic.

Prompt 2

Ultra-realistic full-body cinematic portrait of a 22-year-old young man (100% matching my face) standing beside the grand Durga idol during Durga Puja. He is wearing elegant traditional Bengali attire (white kurta with red festive uttorio), his posture graceful and confident. His face is crystal clear, glowing with devotion and sharp elegance. The Durga idol behind him radiates divine power and festive beauty, illuminated by golden-red light. part-1