In today’s fast-paced world, digital banking has become more than just an option—it is now the standard for how individuals and businesses manage their money, and with rapid technological advancement, the future of digital banking looks more promising than ever as it combines convenience, security, speed, and innovation to offer users a seamless experience in personal finance management, where traditional banking once required long queues and endless paperwork, digital solutions now allow users to complete complex transactions in seconds from their smartphones, and this transformation is being driven by key factors such as artificial intelligence, blockchain technology, mobile-first platforms, regulatory changes, and growing customer demand for better services, because consumers today want

personalized banking experiences where the bank understands their needs and offers relevant financial products without them even asking, and that’s where AI-powered chatbots and recommendation systems are playing a big role, helping banks provide tailored advice, track spending patterns, and even suggest investment options, while blockchain is simultaneously ensuring that transactions remain transparent, secure, and nearly impossible to tamper with, making cross-border payments faster and cheaper than traditional methods, which is highly valuable for individuals working abroad who frequently send money home, at the same time, mobile-first banking platforms are enabling even rural and remote users to access banking services with just a smartphone and internet connection, reducing financial exclusion and helping more people become part of the formal economy, and in countries like India, where UPI has transformed the way people make payments, the shift to digital has been nothing short of revolutionary, with millions of people now preferring QR-code and wallet-based payments over cash, while global players like Apple Pay, Google Pay, and PayPal continue to innovate in their markets, bringing competition that ultimately benefits consumers, however, with all these advancements, security remains a major concern, as cybercriminals are becoming more sophisticated,

leading banks to invest heavily in biometric authentication, multi-factor verification, and AI-driven fraud detection systems to protect their users’ money, and regulatory authorities are also keeping up by introducing strict data protection laws to ensure customers’ privacy, meanwhile, the rise of neobanks—digital-only banks with no physical branches—is further reshaping the industry, as these banks offer lower fees, faster services, and simplified interfaces that appeal particularly to younger generations who prefer convenience over tradition, yet traditional banks are not entirely left behind, as many of them are partnering with fintech companies to modernize their services and retain their customer base, and looking into the future, digital banking is expected to integrate even more deeply with people’s daily lives, possibly merging financial services with social media, e-commerce, and smart devices, so that transactions become truly invisible and frictionless, for example, imagine a future where your fridge automatically orders groceries and pays directly from your digital wallet, or your car pays for fuel through an in-built payment system without you lifting a finger,

such innovations are already being tested and will soon become mainstream, and this level of integration will redefine convenience in financial management, though it also raises questions about data security, ethical use of AI, and consumer awareness, which need to be addressed through stronger education, transparency, and regulation, and for investors, the digital banking industry presents massive opportunities as fintech startups continue to attract billions in funding worldwide, while banks that fail to adapt risk becoming obsolete, meaning individuals too must stay updated and learn how to make the most of digital tools for saving, investing, borrowing, and spending, and overall, the future of digital banking is not just about faster payments or convenient apps, it is about reshaping the way people interact with money altogether, creating a smarter, safer, and more inclusive financial system that empowers users, drives economic growth, and brings financial literacy to millions who were once left out of the system, making digital banking not only a tool for convenience but a catalyst for global financial transformation.

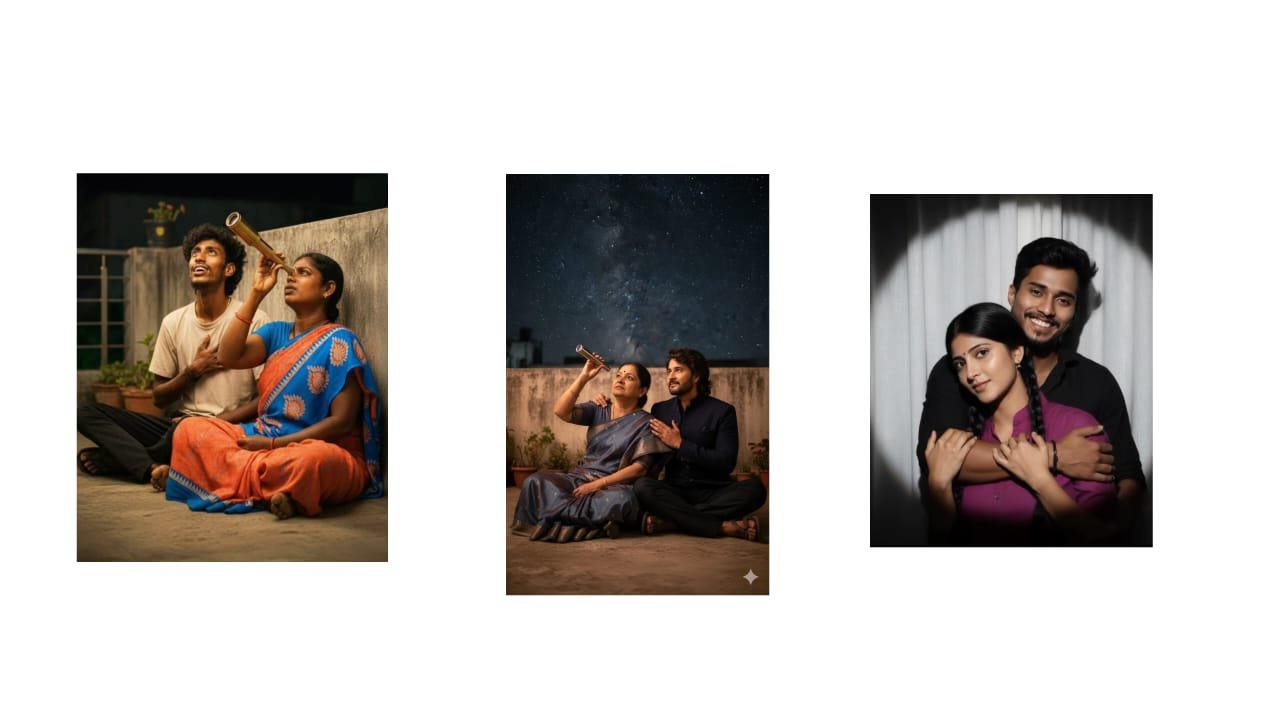

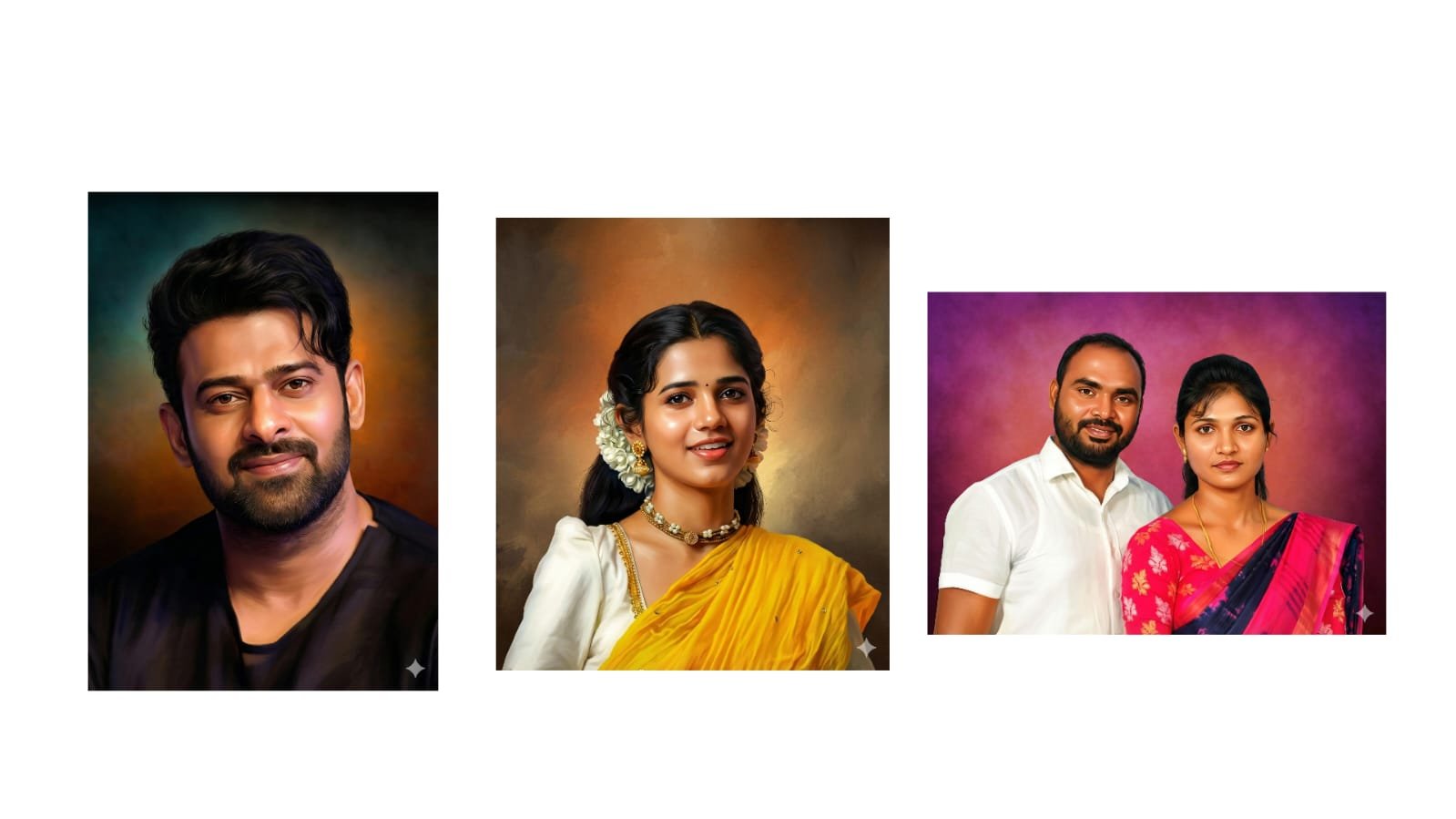

Boy prompt

Use the two picture me and my mother A deeply emotional shot of a of sharing a moment of wonder. We are sitting on the ground against a concrete wall at night on home terrace.my mother, wearing a saree, same dress looks up through a small handheld object like a telescope towards sky . And I sits next to her, gazing upwards with his hand on his chest, same dress with scandals The atmosphere is heartwarming and poignant, with soft, dramatic lighting with HD camera effect with original face

Girl Mother Prompt

A warm emotional night- time rooftop scene. A mother in a traditional lndian saree

sits beside her growm up daughter under a Star filled skey.she is joyfully.

looking through a smatl black color telescope without stand, while the daughter

gazes at the Star with admiration auda hand on his chest, Gentle fairy lights

glow on the wall behind them adding a magical touch. The mood is nostalgic

heartwarming, ánd flled with love, highlighting the bond between.

mother and daughter ultra realistic, cinematic lighting, 8K details.

Girl Boy Love prompt

Light source, such as a flash from a

dark room spread throughout the

photo. Do not change the faces.

Replace the background behind the

two people with a white curtain.

with the guy being close to me like

a couple holding each other