As the world becomes increasingly dependent on technology, the rise of cyber threats has created an urgent demand for protection against financial losses caused by data breaches, hacking, ransomware, phishing attacks, and other forms of cybercrime, making cyber insurance one of the fastest-growing segments in the global insurance industry, and this is not just relevant for large corporations but also for small businesses, startups, and even individuals who are constantly exposed to risks whenever they use online platforms, store data, or conduct digital transactions, because a single cyberattack can result in massive financial damages, loss of sensitive customer information, legal liabilities, reputational harm, and even business shutdowns, and in many cases, the cost of recovery from a data breach can be devastating, often exceeding millions of dollars, which is why cyber insurance

policies have been designed to cover a wide range of expenses including legal fees, forensic investigations, data recovery, customer notification costs, regulatory fines, and even compensation for business interruption, and with the introduction of strict data protection regulations worldwide such as GDPR in Europe and similar laws in other regions, companies are now legally bound to protect personal data, making compliance a major factor driving the adoption of cyber insurance, and insurers are responding by creating flexible policies tailored to different industries such as healthcare, banking, retail, and e-commerce, each of which faces unique cyber risks, for example, hospitals must protect electronic medical records, while banks deal with sophisticated fraud attempts targeting online payments,

and e-commerce platforms are constantly defending against credential theft and account takeovers, and even individuals face threats such as identity theft, credit card fraud, and ransomware, highlighting that cyber insurance is no longer optional but an essential safeguard in today’s connected environment, and beyond financial coverage, many insurers now provide value-added services such as cyber risk assessment, employee training modules, and 24/7 incident response teams to help organizations minimize their vulnerabilities and respond quickly when an attack occurs, further enhancing the importance of cyber insurance as part of a holistic cybersecurity strategy, and the market for cyber insurance is expected to expand rapidly in the coming years as both awareness and attack frequency increase, with experts predicting that global premiums could reach hundreds of billions of dollars by the next decade, making it a lucrative

field not only for insurers but also for investors, technology providers, and cybersecurity professionals, however, challenges remain such as accurately pricing the risk given the constantly evolving nature of cyber threats, handling the lack of historical data compared to traditional insurance fields, and preventing moral hazard where insured organizations may become less careful once they are covered, yet despite these hurdles, the demand for cyber insurance continues to surge as no business can afford to ignore the reality of cyberattacks, and in the future, policies may become even more sophisticated by integrating with real-time cybersecurity tools, using artificial intelligence to dynamically adjust coverage based on threat levels, and offering modular solutions that allow businesses to customize protection according to their specific needs,

while governments too may play a bigger role by mandating cyber insurance for critical sectors like banking, energy, and healthcare to ensure resilience against large-scale cyber incidents, and overall, cyber insurance is emerging as a cornerstone of financial security in the digital era, bridging the gap between cybersecurity measures and financial protection, ensuring that when—not if—a cyber incident occurs, organizations and individuals have the necessary safety net to recover quickly and continue operating without catastrophic losses, making it a critical component of the modern financial landscape and a trend that will only grow stronger as digital dependency deepens across the world.

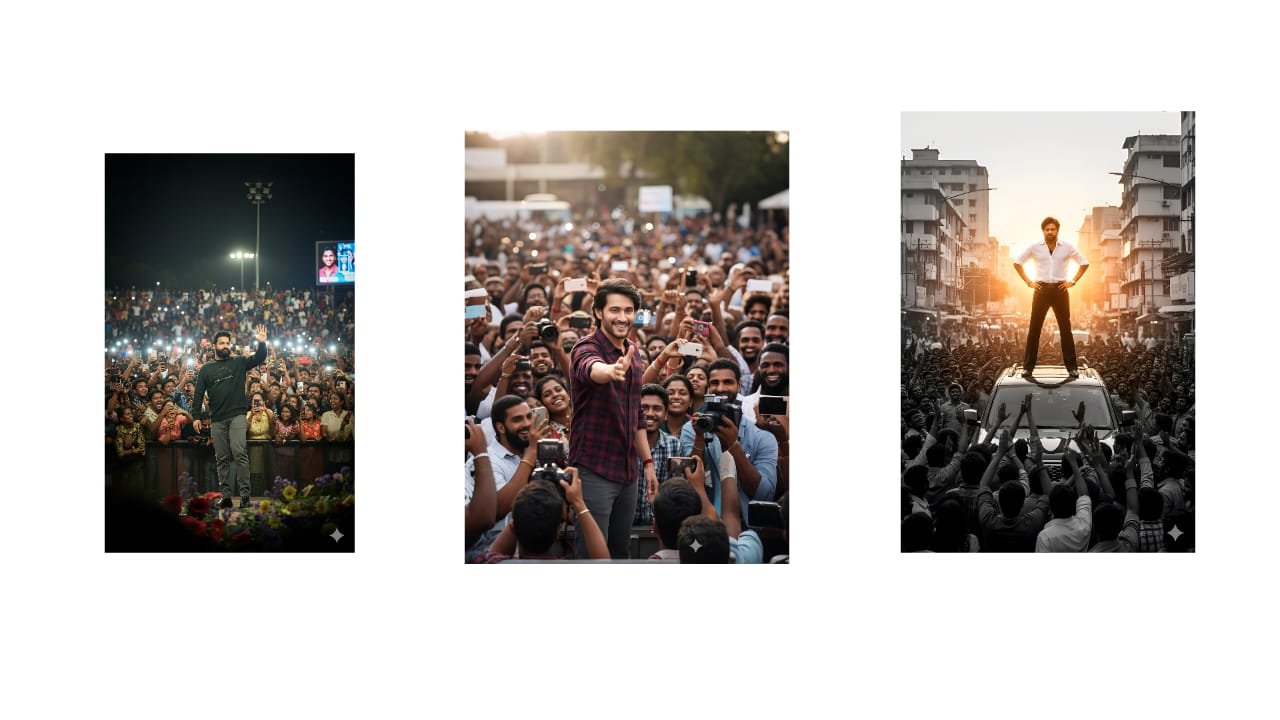

Prompt 1

PUltra realistic candid

photo of a (as in reference),

standing in a crowded place with

people holding cameras and taking

photos. the person show his hand

to audience.The background is

filled with fans and a little chaos of

crowd, giving a true celebrity vibe.

The photo should look like a real-life

captured moment, with natural

lighting, sharp details, and

authentic atmosphere.

Prompt 2

A uploaded image same street scene in an urban setting, with a large crowd gathered. A man stands heroically on top of a vehicle, hands on his hips, gazing toward the horizon. The crowd is packed densely in the background, creating a sense of unity and anticipation. The uploaded image same has a dramatic, cinematic effect with selective color grading: the man is highlighted in the crowd and city surroundings are in b The feels inspiring and iconic, resembling a leader addressing or overseeing a movement. Bright light shines behind him, emphasizing his silhouette."