Life insurance is often considered one of the most essential components of financial planning, but in India and many other countries there exists a strong debate about whether life insurance should be used purely as a protection tool or also as an investment instrument, and the truth lies somewhere in between because while the primary purpose of life insurance is to provide financial security to dependents in case of the untimely death of the policyholder many people treat policies such as endowment plans, money-back plans, and unit-linked insurance plans (ULIPs) as investment options, which creates confusion and sometimes leads to poor financial decisions, and to understand the myths versus reality it is important to break down how life insurance works, as term insurance policies provide pure risk cover at low premiums without maturity benefits making them the best option for protection, while traditional policies like endowment

or whole life combine insurance with guaranteed returns but generally deliver low yields of around 4% to 6%, whereas ULIPs allow policyholders to invest premiums in equity, debt, or balanced funds with the added benefit of life cover and potential market-linked growth, though they come with higher charges and risks, and one major myth is that life insurance is an investment like fixed deposits or mutual funds but in reality insurance is not designed to maximize returns, it is meant to provide a financial safety net ensuring that families are not financially devastated in case of a breadwinner’s absence, and when individuals buy policies solely for investment purposes they often end up with low-yielding products that neither give adequate coverage nor attractive returns, while the reality is that separating protection and investment is a smarter strategy where term insurance provides high coverage at minimal cost and the remaining surplus is invested in mutual funds, stocks, or other instruments to build wealth, another common myth is that life insurance maturity benefits are the best way to save for future goals but the reality is that while policies do offer tax-free payouts under section 10(10D) the effective returns after deducting charges and inflation are far lower than what equity mutual funds or even PPF can generate over the same horizon, and many policyholders also believe that ULIPs are too complex and risky, but the reality is that modern ULIPs regulated by IRDAI come with reduced charges, transparency, and flexibility where investors can switch between equity and debt based on market conditions, making them suitable for long-term disciplined savers who want insurance plus market exposure,

yet another misconception is that life insurance is only useful for married individuals with dependents, but the reality is that young earners can lock in lower premiums and ensure their parents or future dependents are financially protected, while also using investment-linked products for long-term wealth creation, and it is also important to understand tax benefits because under section 80C premiums paid up to ₹1.5 lakh are deductible while maturity proceeds are exempt under section 10(10D) subject to conditions, making life insurance one of the most tax-efficient instruments available,

but relying only on tax benefits without evaluating the adequacy of coverage can be a dangerous mistake since many people buy small policies just for tax saving which fail to protect families adequately, and comparing investment returns of insurance products with other options clearly shows that insurance-linked savings are not the best wealth creators because traditional plans rarely beat inflation whereas mutual funds, equities, and even NPS have delivered superior long-term returns, so the reality is that life insurance should be viewed primarily as a protection-first tool and only secondarily as an investment if chosen carefully, and for those who want a combination of security and wealth building ULIPs with long-term horizons of 10 to 15 years can be a decent option since compounding

and market growth over time offset initial charges, and modern financial advisors widely recommend following the principle of “buy term insurance and invest the rest” where individuals take pure protection through term plans and separately invest surplus in higher-yielding assets to balance safety with growth, and the final truth is that myths around life insurance often arise from aggressive sales pitches where agents push expensive products with commissions rather than analyzing customer needs, so the best approach is to assess financial goals, calculate adequate coverage usually 10 to 15 times annual income, and then decide on the right mix of insurance and investment instruments instead of expecting a single

policy to fulfill all needs, because reality proves that while life insurance is a must-have for financial security, it should not be confused with high-return investment vehicles, and a disciplined combination of term insurance with diversified investments ensures both family protection and long-term wealth creation without falling into myths that often cost investors both money and security.

Prompt

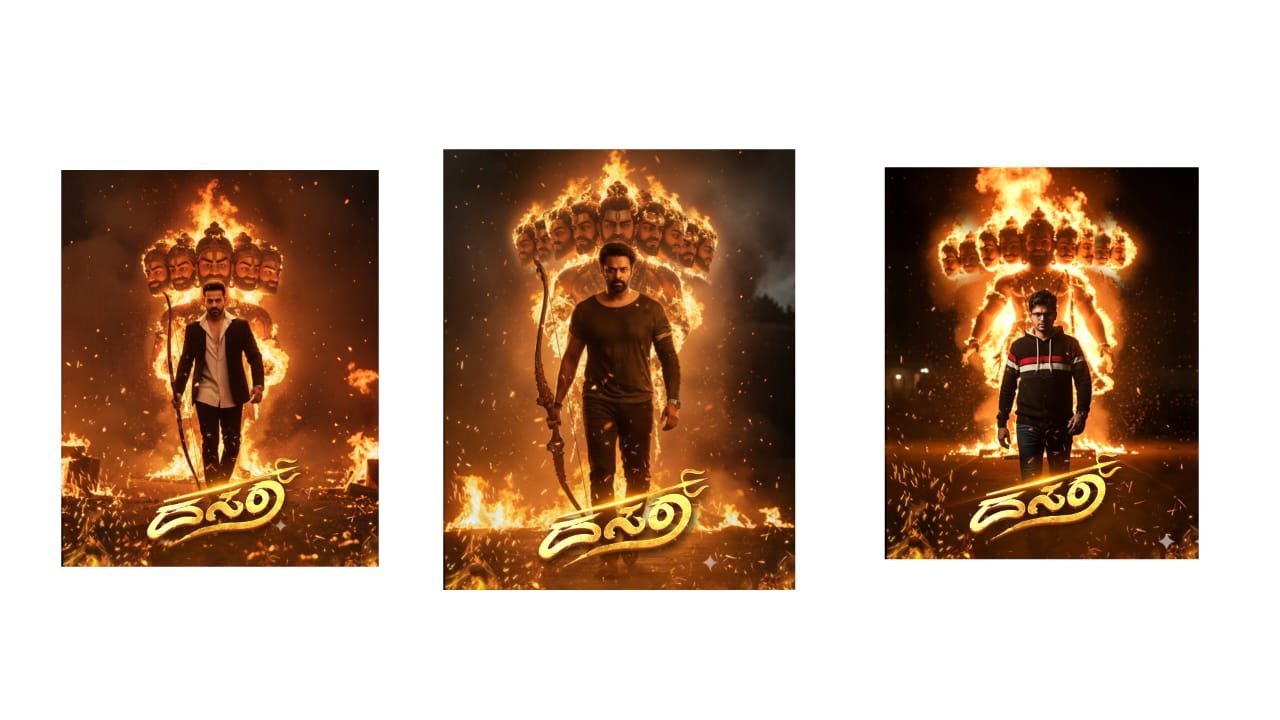

Full-length, low-angle cinematic shot of a man {image uploaded), same dress serious Bow held her hand.in expression, walking straight toward the camera. He's wearing a same dress His right wrist shows a classic round-dial watch, with intese expression. The background is a dramatic, ravana with 9 face statue is burning,

smoky scene bathed in an intense warm orange backlight, filled with drifting ember.genrate

Front fire particle

hyperealistic image,

Photo project link