In 2025, investing has transformed into an effortless digital experience as a new generation of smart investment apps allows users to build wealth with minimal effort and maximum intelligence, combining AI-based automation, real-time analytics, and secure integration with financial markets. Gone are the days when only brokers and financial advisors could manage portfolios — today, fintech apps like Groww, Zerodha, INDmoney, Upstox, and Paytm Money are empowering everyday investors with cutting-edge features once reserved for professionals. These apps use artificial intelligence and machine learning algorithms to analyze market data, recommend investment strategies, and automate trades based on real-time risk profiling. Groww continues to dominate among young investors with its clean interface, SIP tracking tools, and instant mutual fund switching, while Zerodha’s Kite app provides detailed charting, advanced indicators, and margin trading options suited for active traders. INDmoney, on the other hand, acts as an all-in-one financial planner, linking bank accounts, credit cards, insurance, and investments into one dashboard while offering goal-based investing and AI-driven portfolio rebalancing.

Paytm Money’s strength lies in its accessibility, offering zero-commission mutual funds, low-cost equity trading, and automatic portfolio diversification based on user goals and income levels. These apps now integrate with UPI AutoPay, allowing users to set automatic SIPs, recurring stock purchases, and instant withdrawals without additional fees. Security remains a top concern, and most apps now feature 256-bit encryption, two-factor authentication, and biometric logins to protect investor data. The introduction of fractional investing in 2025 has further democratized access, letting users buy shares of premium global companies like Apple, Tesla, and Google for as low as ₹100, bridging the gap between Indian investors and global markets. Robo-advisory tools are another game-changer, offering algorithm-based investment planning that minimizes human bias and maximizes return potential. These tools automatically assess your financial goals, risk appetite, and investment timeline to create a personalized plan that adjusts dynamically as market conditions change. Tax optimization has also become a built-in feature — many apps now suggest the most tax-efficient funds and track capital gains to simplify yearly tax filings. The rise of ESG (Environmental, Social,

and Governance) funds has introduced responsible investing opportunities, allowing investors to earn returns while supporting sustainable companies. In addition, the integration of digital gold and government bonds into these apps has opened safer alternatives for risk-averse users who prefer stability alongside equity growth. With increasing competition, many platforms now offer reward systems, zero-brokerage trades, and cashback on portfolio milestones to enhance user retention and satisfaction. Social investing — where users can view, follow, and learn from top-performing investors — has also become a trend, especially on platforms like INDmoney and Zerodha Varsity. AI-powered chatbots now act as virtual financial assistants, helping users plan SIPs, rebalance portfolios, or even predict future growth based on historical trends. The inclusion of NPS, ULIP, and pension tracking has made long-term financial planning easier for professionals who want all their wealth data in one secure place. Furthermore, 2025 has seen an explosion in crypto-linked investing apps regulated by Indian authorities, offering Bitcoin ETFs and blockchain-based index funds for diversified exposure without the risks of unregulated trading. The government’s push for financial inclusion has also led to simplified KYC verification and instant account creation, enabling anyone with a smartphone to begin investing within minutes.

These changes have collectively redefined how Indians perceive saving and investing — shifting from passive saving habits to proactive wealth-building strategies powered by digital intelligence. As AI-driven financial technology continues to evolve, the next phase of investment apps will likely introduce hyper-personalized automation that not only grows wealth but also adjusts automatically to life events such as salary hikes, inflation changes, or market volatility. For users who value speed, transparency, and security, choosing the right investment app is now the most crucial step toward financial independence in 2025, making these digital platforms not just tools, but indispensable partners in long-term wealth creation.

PROMPT 1

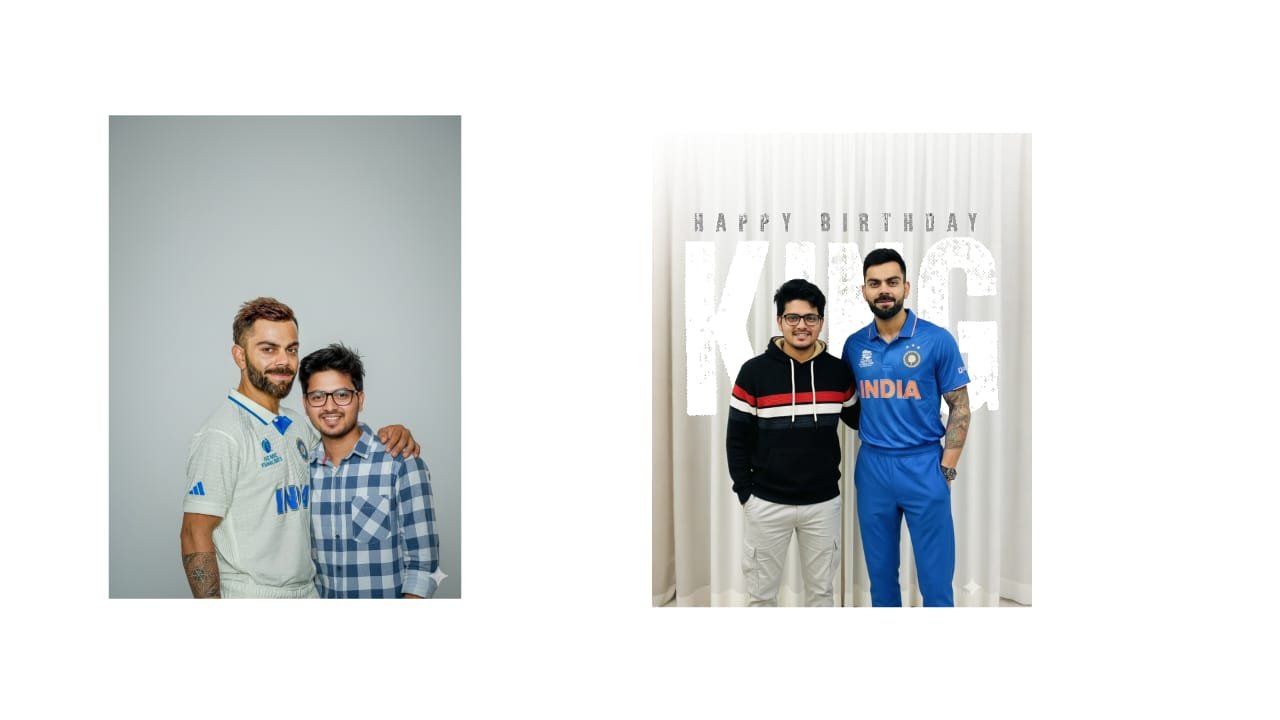

On the given photo, keeping the original face exactly create High Clarity create full photo Merge the two uploaded photos into one realistic family portrait. Keep all facial features 100% intact and natural. Place everyone together in a warm, close pose as if photographed in a studio. Neutral background with soft lighting, balanced colours, and sharp focus on faces. Natural smiles, formal photo look. And The first person rests one hand on the second person’s shoulder in a relaxed pose. Both are standing close together, smiling slightly, and looking directly at the camera like a real candid photograph.

PROMPT 2

A tall man wearing the blue Indian cricket team jersey stands beside another young man in casual clothes. They pose together indoors in front of a white curtain. The cricketer has a short beard and is smiling slightly, while the other man wears a dark hoodie and light gray cargo pants. The atmosphere is friendly and casual, as if they are taking a photo together after a meeting or event.