In 2025, car loans and vehicle financing in India have become easier, cheaper, faster, and more transparent than ever, helping millions of buyers purchase cars, SUVs, CNG vehicles, EVs, and commercial cars with simple documentation and low-interest EMIs. With rising demand for personal mobility, flexible EMI plans, instant approvals, and digital banking, the best car loan options in 2025 come from HDFC Bank, ICICI Bank, SBI, Axis Bank, Kotak Mahindra Bank, IDFC FIRST Bank, Federal Bank, Yes Bank, Bank of Baroda, and financial institutions like Tata Capital, Bajaj Finance, and Mahindra Finance, each offering competitive rates, fast processing, and attractive loan-to-value (LTV) ratios. HDFC Bank Car Loan remains a top choice in 2025 due to its quick digital processing, interest rates starting at 8.7%, high approval limits, and instant e-KYC. HDFC provides financing up to 100% on-road price, making it ideal for customers who want zero down payment options, especially for CNG and petrol vehicles. ICICI Bank Car Loan continues to be a strong competitor, offering interest rates starting at 8.75%, flexible tenures up to 7 years, and a seamless online application with minimal paperwork. ICICI also supports instant OTP-based approval for pre-approved customers with high credit scores. SBI (State Bank of India) remains the most trusted bank for car loans due to its transparent charges, interest rates starting at 8.85%, no hidden fees, and special lower rates for women borrowers. SBI offers “CIBIL score-linked pricing,”

meaning customers with good credit scores get cheaper EMIs. Axis Bank Car Loan is popular for interest rates starting at 8.90%, fast approval timelines, and digital loan agreements. Axis also offers step-up EMIs, balloon EMIs, and flexible repayment structures for salaried professionals and business owners. Kotak Mahindra Bank Car Loan is known for its low processing fees, competitive rates at 9%, and instant approval through video KYC. Kotak offers finance on new, old, and premium vehicles with attractive LTV ratios. IDFC FIRST Bank offers one of the lowest car loan interest rates in 2025 starting at 8.75% with zero foreclosure charges, making it a great choice for borrowers planning to repay early. IDFC also provides flexible tenures and digital tracking of loan status. Federal Bank Car Loan is popular in South India with rates starting at 9.05%, low documentation, and higher approval chances for first-time borrowers. Yes Bank Car Loan continues to attract customers with interest rates around 9%, cashback offers, and fast online approval. Bank of Baroda Car Loan is strong for customers seeking government-backed stability with rates starting at 8.7% for new cars. For customers wanting non-bank financing, Tata Capital Car Loans offer flexible EMIs, longer tenure, and quick approval without heavy documentation, making it ideal for new buyers. Bajaj Finance Vehicle Loan remains extremely popular for those buying CNG cars, commercial vehicles, or used vehicles, providing easy EMIs and competitive pricing. Mahindra Finance Car Loans dominate rural and semi-urban markets with flexible eligibility and approvals for buyers with limited credit history.

In 2025, car loan features have expanded drastically — buyers can now get zero down payment loans, 100% on-road price financing, step-up EMIs, balloon EMIs, no-income-proof loans (for pre-approved customers), instant digital approval, and paperless documentation. Many lenders offer pre-approved car loans based on CIBIL score, salary credits, and existing banking relationships, making it possible to get approval in under 30 minutes. Interest rates in 2025 vary based on credit score, income, employment type, car model, and down payment. Borrowers with a CIBIL score above 750 enjoy the lowest interest rates and highest approval chances. Car prices have increased significantly in India, making EMI planning crucial — most buyers prefer 5 to 7-year loan tenures to keep EMIs low. Apps like HDFC LoanAssist, ICICI iMobile Pay, SBI YONO, Axis App, and IDFC FIRST App help customers calculate EMIs, track loan status, modify repayment dates, or pre-close loans instantly. Many lenders now provide digital RC linking, automatic NOC download, and real-time updates from RTOs. Prepayment and foreclosure charges differ across lenders — banks like IDFC FIRST and SBI often have zero foreclosure fees, making them attractive options.

Car financing in 2025 also includes tie-ups with showrooms where manufacturers offer special financing through Maruti Suzuki Finance, Hyundai Finance, Tata Motors Finance, MG Finance, and Toyota Financial Services. These manufacturer-backed plans often provide seasonal offers, lower interest rates, extended warranty bundles, and zero processing fees. Electric vehicles (EVs) have dedicated financing with lower interest, special subsidies, and battery-warranty coverage. Banks like SBI, HDFC, ICICI, Axis, and Kotak now offer EV-specific loans with cheaper interest rates starting at 7.9% due to government EV incentives. For commercial vehicles like Dzire Tour, WagonR Tour, Ertiga Tour, and CNG taxis, lenders like Shriram Finance, Cholamandalam, and Mahindra Finance provide customized EMI options, GPS-based risk control, and higher LTVs to support cab operators and fleet owners.

Choosing the best car loan in 2025 depends on interest rate, EMI flexibility, processing fees, foreclosure rules, loan tenure, and approval speed. Borrowers should compare offers on platforms like BankBazaar, PaisaBazaar, CreditMantri, and showroom tie-up finance desks. A smart strategy in 2025 is to use loan balance transfer (LBT) to reduce EMI burden — customers can shift high-interest car loans to low-interest banks like IDFC FIRST or SBI, saving thousands of rupees yearly. To get the lowest EMI, borrowers should maintain a strong credit score, show stable income, choose longer tenure, opt for manufacturer-backed offers, and provide a reasonable down payment.

Overall, car loans in India 2025 have become more digital, cheaper, quicker, and transparent than ever before. Whether buying a petrol car, CNG model, diesel vehicle, or an EV, choosing the right financing option ensures smooth ownership, lower EMIs, and complete financial peace of mind. With smart comparison, negotiation, and planning, buyers can get the best car loan deal and enjoy stress-free driving for years to come.

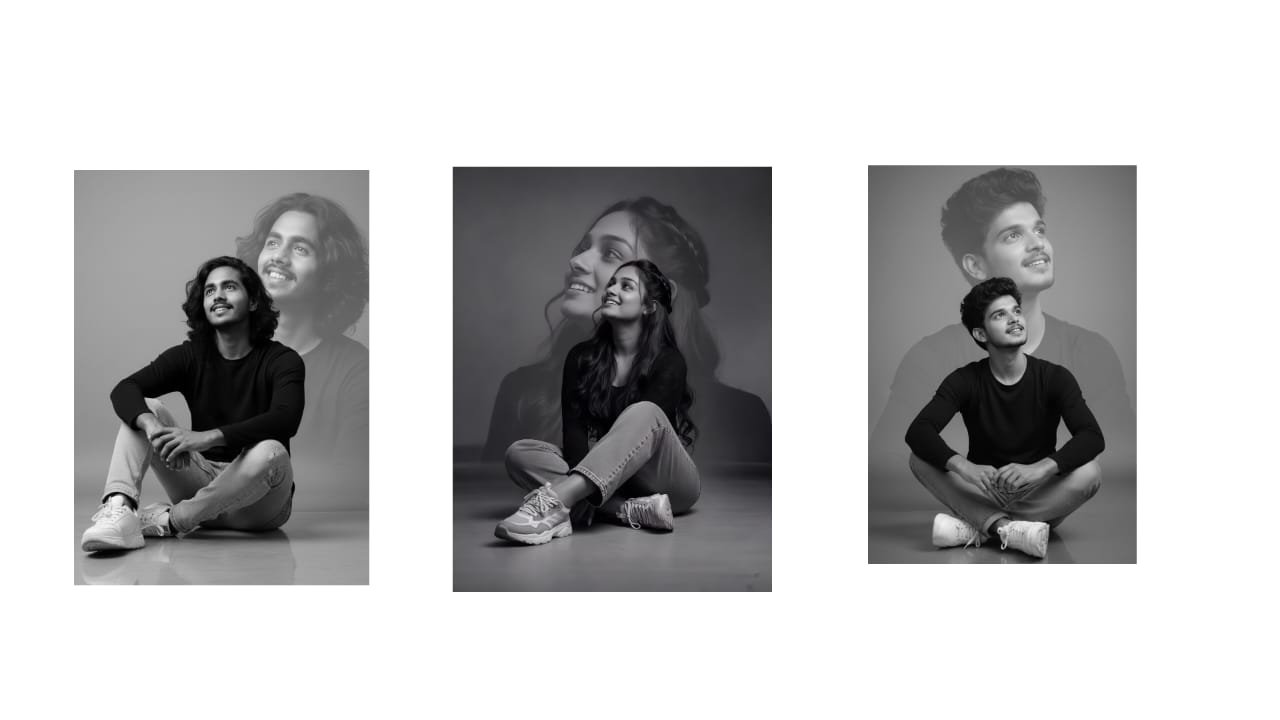

Girl prompt

A create Uploaded image black-and-white portrait of a young woman sitting casually on the floor with legs crossed, smiling softly while looking upward. Uploaded image She has long wavy hair with a braided section, wearing a fitted black long-sleeve top, light denim jeans, and chunky white sneakers. The lighting is soft and studio-style, with smooth shadows. Behind her is a large, semi-transparent double-exposure overlay of her face looking upward with a joyful expression, creating a dreamy and artistic effect. The scene feels modern, minimalistic, and emotional, with a clean grey background and a polished floor reflection. High-resolution, cinematic, moody monochrome aesthetic.

Boy prompt

A create Uploaded image black-and-white portrait of a young Man sitting casually on the floor with legs crossed, smiling softly while looking upward. Uploaded image with a braided section, wearing a fitted black long-sleeve top, light denim jeans, and chunky white sneakers. The lighting is soft and studio-style, with smooth shadows. Behind her is a large, semi-transparent double-exposure overlay of her face looking upward with a joyful expression, creating a dreamy and artistic effect. The scene feels modern, minimalistic, and emotional, with a clean grey background and a polished floor reflection. High-resolution, cinematic, moody monochrome aesthetic.