In 2025, credit cards have become one of the most powerful financial tools for Indians because they offer cashback, reward points, airport lounge access, EMI options, credit score improvement, and purchase protection, but they must be used wisely to avoid high interest, debt traps, and penalties. The best credit card strategies in India 2025 include maintaining low credit utilization, paying bills on time, choosing the right card for your lifestyle, tracking hidden charges, redeeming rewards smartly, converting large purchases to no-cost EMI, using UPI-enabled credit cards, enabling security controls, avoiding cash withdrawals, and maximizing welcome bonuses, each helping users extract maximum value while protecting financial health. The most important rule of credit card use in 2025 is keeping credit utilization below 30%, which means if your card limit is ₹1,00,000, you should use only up to ₹30,000 monthly; this increases credit score and prevents lenders from marking you as high-risk. Paying full outstanding amount on time is critical because even one late payment can reduce credit score by 50–80 points and add interest at 36–42% annually. Choosing the right credit card based on lifestyle is essential—fuel cards are best for daily drivers, cashback cards suit families, reward cards suit heavy spenders, travel cards are perfect for flyers, and shopping cards work well for online users; matching the card to spending habits increases benefit value.

In 2025, UPI-enabled credit cards such as HDFC, SBI, Axis, ICICI, and Kotak RuPay Credit Cards have changed digital payments by allowing users to make UPI transactions directly using their credit limit, meaning grocery shopping, petrol, utility bills, and offline purchases can earn reward points without using debit cards. Smart redeeming of rewards is another important part of credit card management; instead of redeeming points for low-value vouchers, users should convert them to flight tickets, hotel bookings, EMI adjustments, or statement credits to maximize value. Converting big purchases into no-cost EMIs helps avoid paying large interest while still keeping financial flexibility, but users should confirm merchant-based processing fees before choosing EMI. Tracking hidden charges is essential because cards often include annual fees, add-on card fees, cash withdrawal charges, foreign transaction fees, late payment charges, GST, and interest charges; reviewing statements monthly prevents surprises. Security features in 2025 include card lock/unlock, transaction limits, international disable/enable, UPI device binding, tokenization, and instant fraud alerts, and activating all these features ensures maximum safety. Avoiding ATM cash withdrawals using a credit card is extremely important because they incur high fees + immediate interest with no interest-free period.

Banks in 2025 offer welcome bonuses like large reward points, cashback, or vouchers; users should choose cards that offer maximum joining benefits and then downgrade or close them after the fee reversal period if benefits decline. High-limit credit cards should be used responsibly—keeping a high limit improves credit score but overspending reduces financial stability. Maintaining multiple cards diversifies credit and increases total credit limit, reducing utilization rate and boosting score, but users must track all due dates to avoid missing payments. Apps like CRED, OneScore, IDFC FIRST, HDFC MyCards, SBI Card App, Axis Mobile, and ICICI iMobile Pay help track credit card usage, reward points, statements, and payment reminders, making management easier.

Interest-free period optimization is a powerful strategy—users should time their purchases right after the billing date to get 45–52 days of interest-free credit. Using credit cards for recurring bill payments like OTT, broadband, electricity, LPG, DTH, and mobile recharge earns reward points consistently. Travel credit cards in 2025 offer airport lounge access, flight ticket discounts, hotel deals, complimentary meals, and travel insurance, making them valuable for frequent travelers. Users should also take advantage of bank-specific instant discounts during sales on Amazon, Flipkart, Myntra, Croma, and Swiggy, which offer savings up to 10–15%.

Building a strong credit score with credit cards in 2025 involves consistent on-time payments, maintaining low utilization, keeping accounts open longer, avoiding loan settlements, and not applying for too many cards at once. Reviewing credit reports from CIBIL, Experian, CRIF, and Equifax helps identify errors early. Card users must avoid impulse purchases, gambling apps, risky uses, and unverified websites. Protecting against fraud is critical—never share OTP, CVV, PIN, or login credentials. If the card is lost, users must immediately lock or block the card through the bank app.

Overall, the best credit card tips in India 2025 include smart earning, safe spending, full payment discipline, feature optimization, and financial awareness. With correct usage, credit cards become powerful tools for rewards, savings, travel, offers, cashbacks, and credit score improvement, helping users enjoy financial flexibility while staying completely safe from debt traps. With discipline and knowledge, credit cards in 2025 can transform into strong wealth-supporting tools for every Indian user.

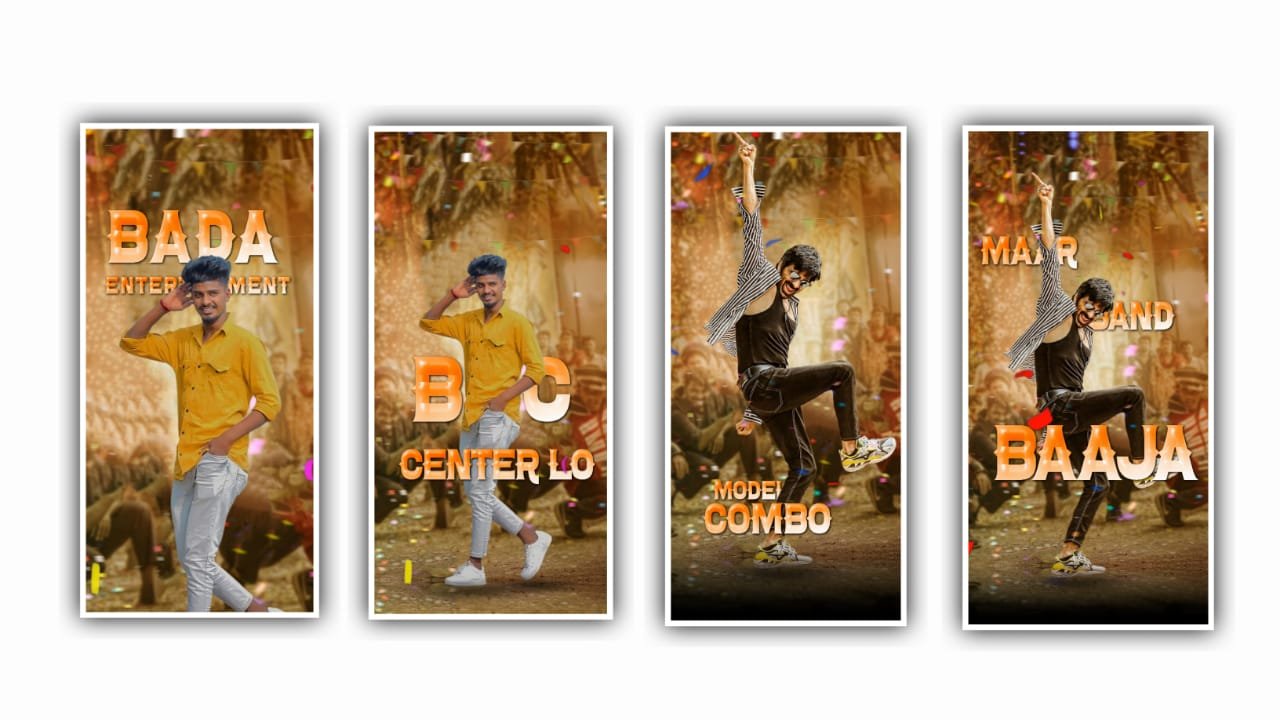

Prompt

“Create a cinematic

digital illustration of the person in the

reference photo. Maintain the exact

face, identity, hairstyle, expression, skin

tone, and pose with zero distortion.

Transform the entire scene into a deep

red high-contrast Tamil gangster movie

poster style. Replace the background

with red gradients, smoky atmosphere,

and subtle textures. Add bold

comic-book shading, thick outlines,

strong black shadows, and glossy

highlights on the sin and clothes.

Stylize the outfit with richer tones, clean

folds, and dynamic lighting while

keeping the original clothing design. Add

intense highlights to the jawline,

cheekbones, and edges of the body.

Maintain the original pose and attitude.

Create a gritty, powerful, cinematic

mood with dramatic lighting and high

contrast. Ultra-detailed, sharp lines,

vibrant red atmosphere, action-movie

poster energy, 4K illustration.”

Alight Motion (template)

Cap Cut (template)

XML file

Song link

Cap cut App V15.3.0