In 2025, business current account freezes have become a major operational risk for traders, transporters, online sellers, freelancers, and MSMEs in India, as banks implement stricter compliance, anti-money laundering rules, and tax data matching, often freezing accounts suddenly when unusual or unexplained transactions are detected, making it crucial for business owners to understand why freezes happen and how to resolve them without losing customers or cash flow. One of the most common triggers is mismatch between business income reported in GST or income tax returns and actual bank deposits, especially when large credits appear without clear invoice or contract backing, leading compliance systems to flag the account for review. Cash-heavy businesses face higher freeze risk because cash deposits are difficult to match with digital invoices, and even genuine sales can look suspicious without proper documentation.

Another major cause is receiving payments from unknown or risky sources, including transactions linked to cybercrime, scam networks, or flagged accounts, which can freeze not only the sender but also recipient accounts temporarily until investigation clears the trail. Many businesses unknowingly get caught in this net when they receive payments from new customers without proper KYC or documentation. Incomplete or outdated KYC is another frequent trigger; missing PAN-Aadhaar linkage, expired business registration documents, or outdated addresses can result in debit restrictions or full freezes until updated.

E-commerce sellers and freelancers face additional risk when platform payouts do not match GST filings or declared turnover, as automated systems detect discrepancies. Loan app or digital wallet misuse also contributes, as routing funds through business accounts can associate them with high-risk networks. Even genuine businesses experience freezes due to technical or reporting errors, making proactive compliance essential.

The first step after a freeze is obtaining written clarification from the bank regarding the exact reason, as solutions differ for KYC issues, tax mismatches, or cybercrime instructions. Submitting invoices, GST returns, contracts, and bank statements helps resolve most compliance reviews. Filing a formal representation with the bank and following escalation channels speeds up resolution, while silence or panic worsens delays.

Business owners must avoid paying unofficial “agents” who promise instant unfreeze, as no private party can override bank or police instructions legally. Instead, structured documentation, transparency, and timely response are the only safe path. Maintaining separate accounts for different business activities, reconciling GST and bank data monthly, and keeping proper records significantly reduce freeze risk.

Ultimately, business current account freezes in India in 2025 are not punishment but compliance checkpoints, and businesses that understand triggers, maintain clean documentation, and respond professionally regain access quickly without long-term damage. Treating compliance as part of business operations protects cash flow, customer trust, and growth in an increasingly regulated digital economy.

Prompt 1

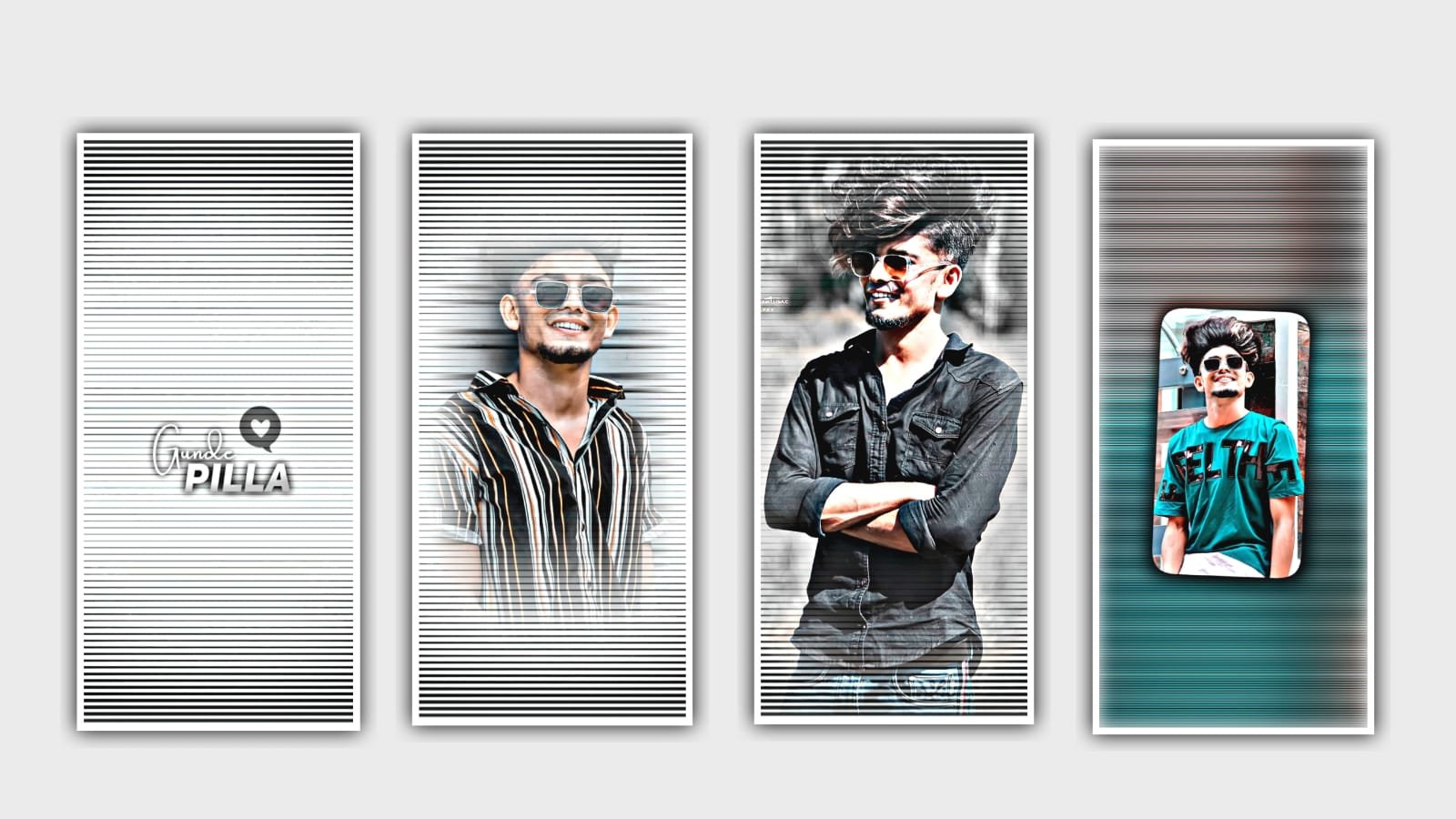

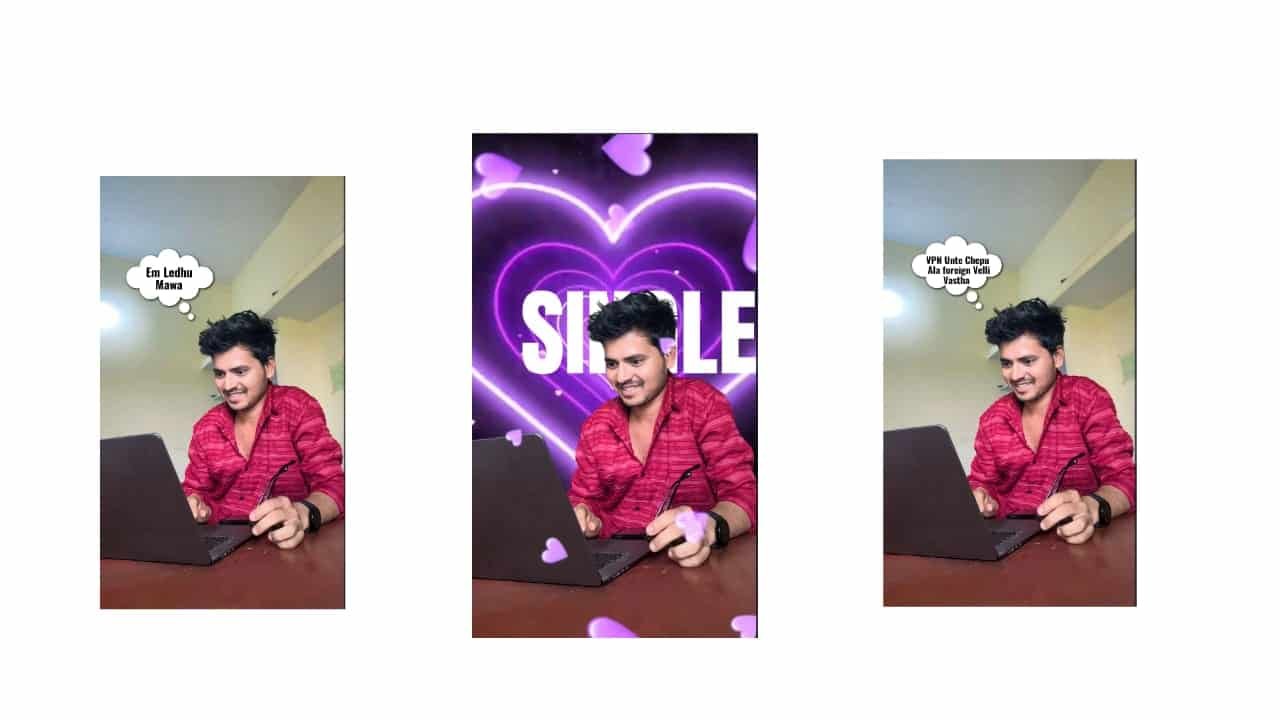

A Uploaded image create cinematic red-and-black movie poster featuring a rugged man in same dress Same pose, a and a pendant necklace. He is looking with a confident, intense expression. Dramatic red lighting floods the scene, with smoky textures and grunge scratches in the background. High contrast, moody atmosphere, neo-noir style, South Indian action film poster aesthetic. Bold handwritten Telugu-style typography (Spirit )in glowing red across the lower half. Dark vignette edges, cinematic shadows, ultra-detailed, sharp focus, stylized color grading, 4K resolution.

Prompt 2A Uploaded image create cinematic red-and-black movie poster featuring a rugged man in same dress Same pose, a and a pendant necklace. He is looking with a confident, intense expression. Dramatic red lighting floods the scene, with smoky textures and grunge scratches in the background. High contrast, moody atmosphere, neo-noir style, South Indian action film poster aesthetic. Bold handwritten Telugu-style typography (ప్రభాస్)in glowing red across the lower half. Dark vignette edges, cinematic shadows, ultra-detailed, sharp focus, stylized color grading, 4K resolution.