In recent years personal loans have become one of the most widely used financial tools for managing expenses such as medical needs, education costs, home upgrades, business investments, and emergency situations, yet many applicants are confused when approvals are delayed, limits are reduced, or applications are rejected without a clear explanation, because banks and financial institutions rely on a detailed internal evaluation system that goes far beyond basic income checks; while most people assume salary alone determines eligibility, lenders actually assess overall financial behavior, starting with income stability rather than income size, meaning a consistent monthly earning pattern over time often carries more weight than a high but irregular income stream, as predictable cash flow reduces repayment risk; employment history also plays a silent but powerful role, where longer tenure with the same employer or steady self-employment records signal reliability, while frequent job

changes or gaps can trigger additional scrutiny even if earnings are strong; existing financial commitments are another critical factor, as banks calculate a borrower’s obligation ratio by comparing current liabilities such as credit cards, vehicle loans, and housing payments against monthly income, and when this ratio exceeds a comfortable threshold, lenders may lower the approved amount or extend longer tenures to reduce perceived strain; repayment behavior on previous credit products is closely analyzed, not only to see whether payments were made on time, but also to observe patterns like repeated delays, restructuring requests, or early settlements, each of which provides insight into how an applicant handles financial pressure; one overlooked element is bank account conduct, where lenders evaluate average monthly balances, frequency of overdrafts, returned payments, and transaction consistency, because a well-maintained account reflects disciplined money management regardless of income level; digital footprints are increasingly

influential, as many lenders now use automated systems to analyze spending habits, subscription patterns, and payment regularity, allowing them to assess lifestyle sustainability and future repayment capacity with greater accuracy; loan purpose also matters more than most applicants realize, since clearly defined and reasonable use cases such as debt consolidation or skill development are often viewed more favorably than vague or high-risk purposes, which can affect approval speed and offered terms; documentation accuracy plays a surprisingly large role as well, because even minor mismatches in addresses, employment details, or identity records across documents can trigger verification delays or manual reviews, slowing down the process significantly; applicants often make the mistake of submitting multiple loan requests

simultaneously, unaware that this behavior can signal urgency or financial distress, so spacing applications and choosing the most suitable lender based on profile compatibility can greatly improve success rates; maintaining a healthy financial buffer before applying, such as keeping sufficient account balances and avoiding large discretionary expenses, can positively influence lender confidence during evaluation; modern lending systems also factor in age-based financial maturity, where applicants within stable earning years are often considered lower risk compared to those just entering the workforce or nearing retirement, although this varies by institution; transparency is another key element, as lenders value applicants who disclose accurate financial details upfront, because inconsistencies discovered later can lead to cancellations even after provisional approvals; understanding that loan approval is not

a judgment of worth but a risk calculation allows applicants to approach the process strategically, improving outcomes through preparation rather than trial and error; by aligning income stability, managing existing obligations wisely, maintaining clean documentation, and applying with a clear financial plan, borrowers can significantly increase approval confidence, secure better terms, and build long-term trust with financial institutions, turning personal loans into effective tools for growth rather than sources of financial stress.

Prompt 1

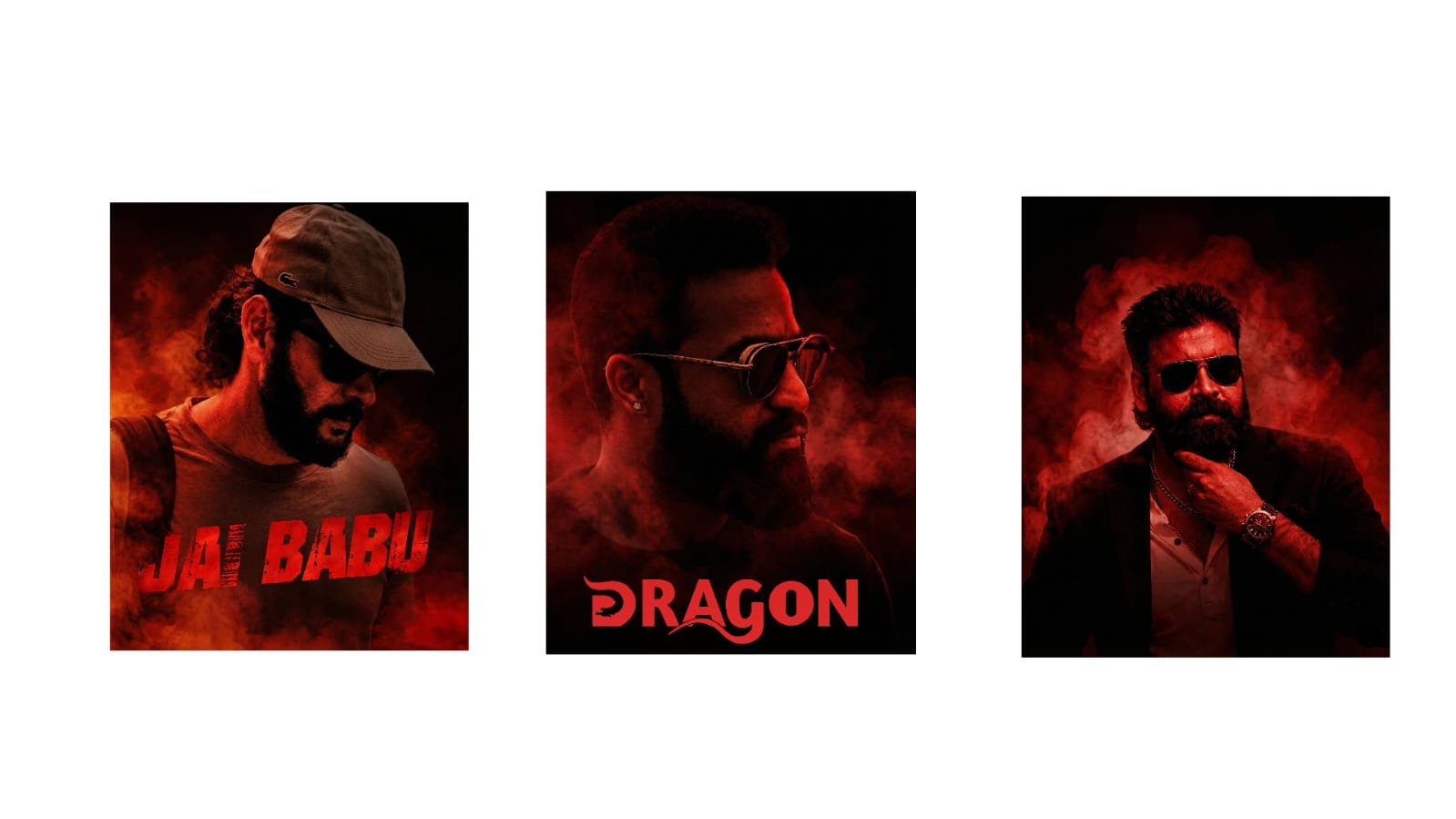

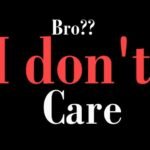

A Uploaded image A dark, intense cinematic poster portrait of a rugged South Indian action-hero type man, upload image same pose slightly same hair a thick full same beard and moustache, and wears black sunglasses. His expression is calm, powerful, and intimidating. Dramatic red lighting dominates the scene, with deep shadows and high contrast. Thick red smoke and mist swirl around his head and shoulders, blending into a black background, creating a fiery, volcanic atmosphere. Strong side lighting sculpts the face, emphasizing texture, grit, and masculinity. Ultra-cinematic color grading, heavy reds and blacks, high clarity, sharp focus, poster-style composition. At the bottom, bold distressed cinematic typography Various font style “Dragon” in glowing red letters. Epic movie poster aesthetic, ultra-realistic, 8K, dramatic mood, action film promotion style.

Prompt 2

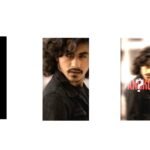

A Uploaded image A dark, intense cinematic poster portrait of a rugged South Indian action-hero type man, Uploaded image same pose slightly same hair and moustache, and wears black sunglasses. His expression is calm, powerful, and intimidating. Dramatic red lighting dominates the scene, with deep shadows and high contrast. Thick red smoke and mist swirl around his head and shoulders, blending into a black background, creating a fiery, volcanic atmosphere. Strong side lighting sculpts the face, emphasizing texture, grit, and masculinity. Ultra-cinematic color grading, heavy reds and blacks, high clarity, sharp focus, poster-style composition. Epic movie poster aesthetic, ultra-realistic, 8K, dramatic mood, action film promotion style.