Credit cards are one of the most powerful financial tools available today, offering convenience, security, rewards, and short-term flexibility, yet they are also one of the most misunderstood products, often leading people into long-term financial stress simply because they are used without a clear strategy. The difference between benefiting from credit cards and struggling with them lies not in income level but in usage behavior, planning, and awareness. Many users treat credit limits as extensions of income rather than temporary borrowing tools, which quickly creates repayment pressure when billing cycles arrive. A smart approach begins with understanding that a credit card is not additional money but a payment method that requires disciplined repayment within a defined period.

One of the most important habits for safe usage is maintaining low utilization relative to available limits, as consistently high balances, even when paid on time, can signal financial strain and reduce flexibility in future borrowing decisions. Timely payments are essential, but paying only minimum amounts prolongs repayment cycles and increases total cost over time, turning short-term convenience into long-term burden. Responsible users aim to clear full balances whenever possible, ensuring that interest does not accumulate and transform manageable spending into ongoing debt. Another key principle is aligning card usage with predictable expenses such as utilities, subscriptions, or planned purchases, rather than emotional or impulse spending, which often leads to regret. Reward programs can be beneficial when spending aligns with existing needs, but chasing points or cashback incentives by increasing unnecessary purchases defeats their purpose.

Many people underestimate the psychological effect of digital spending, as swiping a card or tapping a phone feels less tangible than paying with cash, making it easier to exceed budgets without immediate awareness. Regular review of statements helps maintain control, as small recurring charges or unnoticed transactions can quietly inflate balances over time. Setting spending alerts and reminders creates accountability and prevents surprises before due dates. Another overlooked factor is having a clear repayment plan before making larger purchases, ensuring that installment conversions or structured repayments fit comfortably within monthly cash flow. Applying for multiple credit cards in a short period may appear attractive for offers, but it can complicate management and increase the risk of missed payments or overextension. Simplicity often leads to better outcomes, with fewer cards managed responsibly outperforming multiple accounts handled carelessly.

Credit cards also provide security advantages such as fraud protection and dispute mechanisms, making them safer than direct cash transactions when used carefully, but this benefit only applies when monitoring is consistent and suspicious activity is addressed immediately. Financial stability improves when credit cards are integrated into a broader money management plan that includes savings, emergency reserves, and controlled commitments rather than serving as backup funding for shortfalls. Users who treat credit cards as strategic tools rather than lifestyle enhancers are more likely to build long-term financial strength and maintain flexibility during uncertain times.

The modern financial environment rewards responsible behavior, and those who combine awareness, discipline, and structured repayment habits often enjoy the benefits of convenience without experiencing the stress of accumulated debt. Ultimately, credit cards are neither inherently good nor bad; their impact depends entirely on how they are used, and individuals who approach them with clarity and intentional control can transform them into valuable instruments that support stability, security, and smart financial growth instead of becoming sources of financial pressure.

Prompt

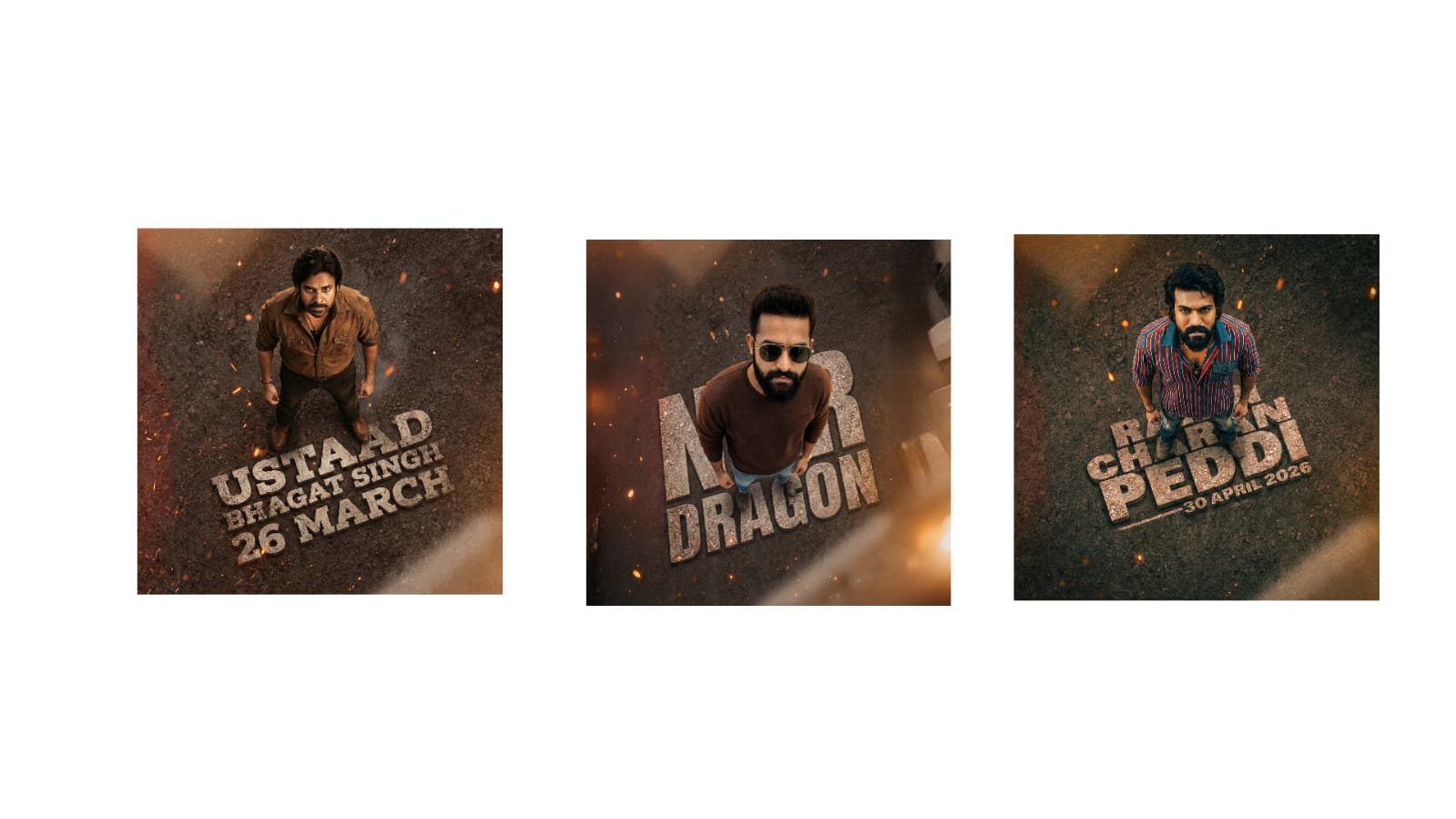

A Uploaded image create cinematic movie poster shot from a dramatic top-down angle. A rugged South Asian man in his late 20s–30s stands on dusty, cracked ground, looking up with intense, defiant eyes. He has thick same hair, same dress a, and a battle-worn expression. He wears a dark, sweat-stained shirt and earth-toned pants, giving a raw, grounded look. Warm orange embers float through the air, creating a fiery, dramatic atmosphere. Bold stone-textured typography is embedded into the ground beneath him, reading Under his feet “RAN CHARAN PEDDI,” with a release date below. High contrast lighting, gritty realism, epic tone, cinematic color grading, ultra-detailed, sharp focus, 4K film poster style.

Project 2

A Uploaded image create Top-down cinematic portrait of a stylish Indian man standing on dark textured ground, looking up confidently at the camera. He wears a brown corduroy blazer over a mustard-yellow shirt, slightly open collar with a pendant necklace. Warm dramatic lighting with orange sparks and ember particles floating in the air, creating a fiery cinematic atmosphere. The ground has bold cracked stone typography embedded into it reading “VARANASI .” Moody color grading, high contrast, sharp focus, ultra-detailed skin texture, shallow depth of field, epic movie poster style, 4K resolution, dramatic shadows, gritty texture background.