Health insurance offered through banks has rapidly become one of the most trusted and convenient financial protection solutions for individuals and families seeking security against rising medical expenses, yet many customers still do not fully understand how bank-linked health insurance works or why it is becoming an essential component of modern financial planning. As healthcare costs continue to increase globally, even minor medical treatments can create significant financial pressure, making health insurance no longer a luxury but a necessary safeguard for long-term financial stability. Banks today collaborate with leading insurance providers to offer comprehensive health coverage plans that combine financial convenience with structured protection, allowing customers to access medical coverage directly through their banking services. One of the primary advantages of purchasing health insurance through banks is accessibility, as customers can easily apply,

manage policies, and pay premiums using existing bank accounts without complicated procedures or extensive documentation. This simplified process encourages more individuals to obtain health protection and reduces the risk of being financially unprepared during medical emergencies. Bank-linked health insurance policies typically provide coverage for hospitalization expenses, pre and post-treatment costs, emergency medical care, and in some cases preventive healthcare services, ensuring that policyholders receive comprehensive financial support when facing health-related challenges. This protection prevents individuals from using savings, selling assets, or taking loans to manage unexpected medical bills, preserving long-term financial goals and maintaining economic stability within households. Another major benefit is cashless treatment facilities offered by many bank-associated insurance plans, allowing policyholders to receive medical services at network hospitals without immediate payment, which reduces stress during critical situations and ensures timely access to healthcare.

This feature is particularly valuable during emergencies when arranging funds quickly may be difficult. Bank health insurance also supports family protection by offering coverage plans that include dependents such as spouses, children, and parents, ensuring that the entire household receives financial security against medical risks. Family coverage policies provide cost-effective solutions compared to individual plans and create a unified protection system that safeguards overall family well-being. Financial planning experts emphasize that health risks represent one of the greatest threats to long-term financial stability because unexpected medical expenses can disrupt years of savings and investment efforts, and bank-linked health insurance provides a structured defense against such risks. In addition to financial protection, many bank health insurance policies offer additional benefits such as annual health checkups, wellness programs, and preventive care support that encourage healthier lifestyles and early detection of medical conditions.

These preventive measures help reduce long-term healthcare costs and improve overall quality of life. Digital banking technology has further enhanced policy management by enabling customers to track coverage details, submit claims, access policy documents, and receive renewal notifications through mobile applications, improving transparency and convenience. Customers can also monitor premium payments and update personal information easily, ensuring continuous coverage without administrative complications. Another important advantage is the reliability and credibility associated with bank-linked insurance products, as regulated financial institutions follow strict compliance standards and partner with authorized insurance providers, ensuring customer trust and policy authenticity. This structured environment reduces the risk of fraudulent schemes and provides greater assurance regarding claim settlement processes. Cost efficiency is another factor contributing to the popularity of bank health insurance, as banks often provide competitive premium rates and flexible payment options that make health coverage more affordable and accessible to a wider

population. Some banks also offer premium discounts or special benefits for long-term customers, further enhancing value. Despite these advantages, customers must carefully evaluate policy terms, coverage limits, waiting periods, and exclusions before selecting a plan, ensuring that the chosen policy aligns with individual healthcare needs and financial capacity. Understanding policy conditions helps prevent misunderstandings during claim situations and ensures maximum benefit from the coverage. Financial stability in today’s uncertain world depends not only on earning and saving money but also on protecting financial resources against unpredictable risks such as medical emergencies, and bank-linked health insurance provides this essential protection by combining financial services with healthcare security. As economic conditions and healthcare costs continue to evolve, individuals who integrate health insurance into their financial planning demonstrate foresight and responsibility by safeguarding their income, protecting their families, and maintaining long-term financial resilience.

Bank health insurance represents a comprehensive financial protection strategy that supports both immediate healthcare needs and future financial security, ensuring that unexpected medical situations do not compromise financial independence or disrupt carefully planned goals. By understanding and utilizing health insurance through banking services, individuals can build stronger financial foundations, reduce uncertainty, and create a more secure future for themselves and their families.

Prompt girl

A Uploaded image create full-body realistic wide-angle photograph of a stylish upload women same dress standing and leaning against a wall with his eyes closed and arms crossed and leg-crossed in a peaceful pose. behind him is a massive, vibrant mural of lord shiva face with looking at him. the man is wearing a same dress same hair with photo size 4:5

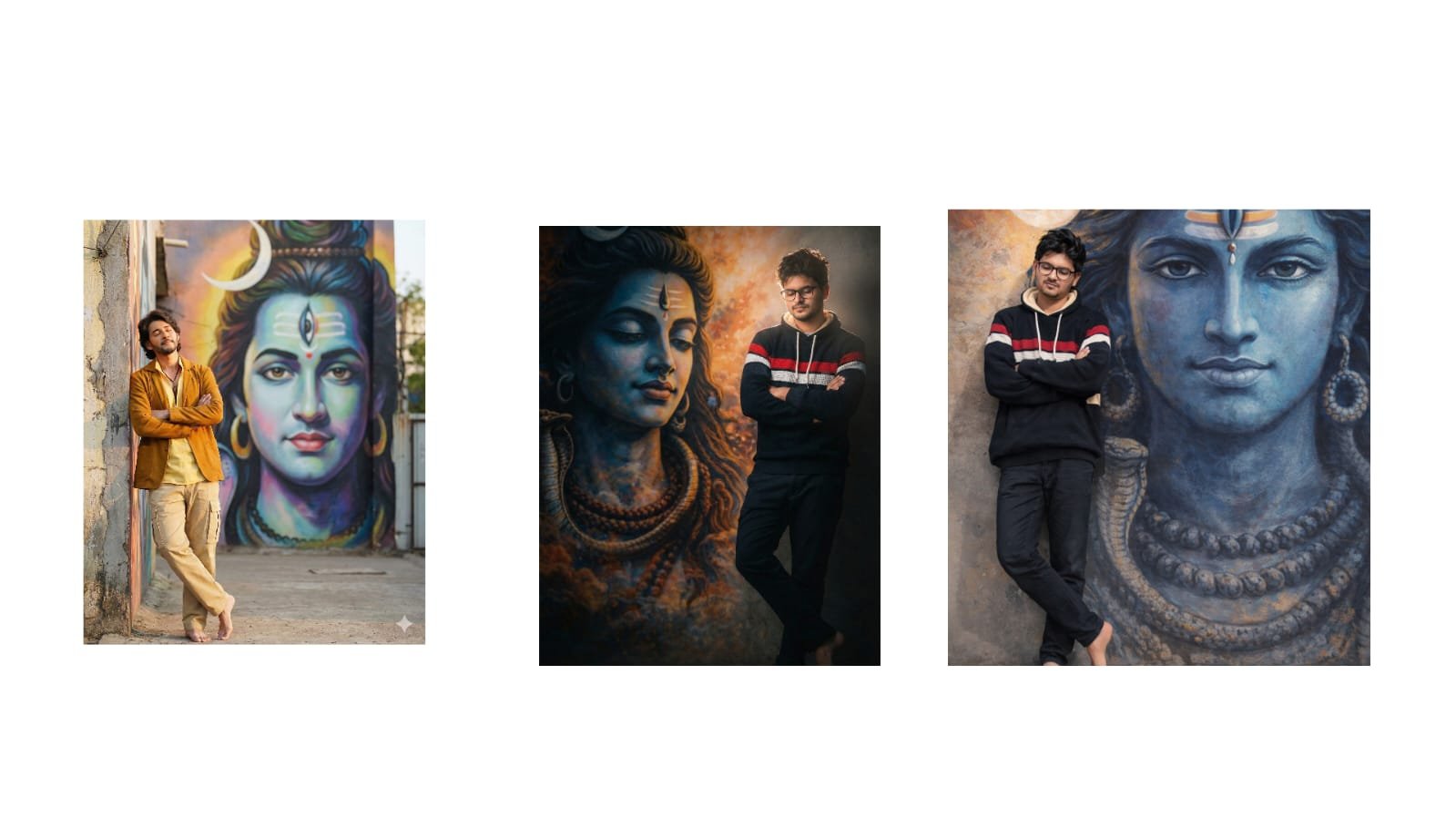

Prompt :- 1

A Uploaded image create full-body realistic wide-angle photograph of a stylish upload man same dress standing and leaning against a wall with his eyes closed and arms crossed and leg-crossed in a peaceful pose. behind him is a massive, vibrant mural of lord shiva face with looking at him. the man is wearing a same dress with barefoot.he has voluminous, messy dark same hair with photo size 4:5

Prompt 2

A Uploaded image create full-body realistic wide-angle photograph of a stylish upload man same dress standing and leaning against a wall with his eyes closed and arms crossed and leg-crossed in a peaceful pose. behind him is a massive, vibrant mural of lord shiva face with looking at him. the man is wearing a loose oversized same dress same eye glasses with barefoot.he has voluminous, messy dark wavy hair with photo size 4:5