Retirement planning has become one of the most important financial decisions for individuals who want to secure their future income, maintain financial independence, and protect their lifestyle after their working years, and choosing the best retirement plan helps build long-term financial stability while reducing future financial uncertainty.

Many people focus on short-term financial goals such as income generation, expenses, and asset purchases but fail to plan for retirement, which can create serious financial challenges later in life when regular income stops. A well-structured retirement plan provides stable income, financial security, and peace of mind by ensuring that individuals can manage daily expenses, healthcare costs, and long-term needs without depending on others. Understanding different retirement planning options helps individuals choose suitable financial strategies that support wealth accumulation and future financial protection.

One of the most important benefits of retirement planning is financial independence, which allows individuals to maintain their lifestyle without relying on family members or external financial support.

Retirement plans create a financial cushion that provides regular income after retirement and ensures that essential expenses such as housing, healthcare, and daily living costs are covered. Early planning allows individuals to build sufficient savings over time and reduce financial pressure in later years.

Pension plans are one of the most common retirement investment options that provide guaranteed income after retirement. These plans allow individuals to invest regularly during their working years and receive fixed income after retirement age, ensuring stable financial support. Pension plans are suitable for individuals seeking low-risk and predictable returns with long-term financial security. Many pension plans also provide tax benefits on contributions, making them attractive for individuals looking to reduce tax liability while planning retirement.

Provident fund schemes are another popular retirement savings option that encourages disciplined long-term investment. These funds provide stable returns, government-backed security, and long-term wealth accumulation. Regular contributions to provident funds help individuals build retirement corpus gradually while benefiting from compound interest growth. The safety and reliability of provident fund investments make them ideal for risk-averse investors seeking secure retirement savings.

Retirement insurance plans combine life insurance protection with long-term savings, providing financial support to policyholders and their families. These plans offer maturity benefits after retirement and financial protection in case of unexpected events. Retirement insurance ensures that individuals receive income during retirement while protecting family financial security. This dual benefit makes retirement insurance a valuable component of financial planning.

Mutual fund retirement plans are suitable for individuals seeking higher returns and long-term wealth growth. These market-linked investments provide potential for higher earnings compared to traditional savings options, although they involve certain level of risk. Systematic investment in mutual funds helps build large retirement corpus over time and provides flexibility in investment strategy. Long-term investment approach helps manage market fluctuations and maximize returns.

National pension schemes provide structured retirement planning with balanced investment options in equity and fixed income instruments.

These schemes encourage regular contributions and provide stable income after retirement. Pension schemes offer flexibility, tax benefits, and long-term financial growth, making them suitable for individuals planning early retirement savings.

Another important factor in retirement planning is inflation management because rising cost of living reduces purchasing power over time. Retirement plans should generate sufficient returns to maintain financial stability despite increasing expenses. Investing in diversified financial products helps protect savings from inflation and ensures long-term financial security.

Healthcare expenses are another major concern during retirement because medical costs tend to increase with age. Including health insurance in retirement planning helps manage medical expenses and protects retirement savings from unexpected healthcare costs. Comprehensive financial planning includes both retirement savings and medical protection.

Tax benefits play an important role in retirement planning because many retirement investment options provide tax deductions and tax-efficient returns. These benefits help individuals maximize savings and improve financial efficiency. Proper tax planning increases retirement corpus and reduces financial burden during working years.

Starting retirement planning early provides significant advantage because longer investment duration allows greater wealth accumulation through compound growth. Even small investments made consistently over long period can generate substantial retirement savings. Delaying retirement planning reduces investment time and increases financial pressure later

Financial experts recommend diversifying retirement investments across multiple financial products to balance risk and return. Diversification protects savings from market volatility and ensures stable financial growth. Individuals should evaluate risk tolerance, income level, and financial goals before selecting retirement plans.

Digital banking and investment platforms have simplified retirement planning by providing online investment tools, retirement calculators, and financial advisory services. These tools help individuals estimate retirement needs, track investment growth, and make informed financial decisions.

Prompt

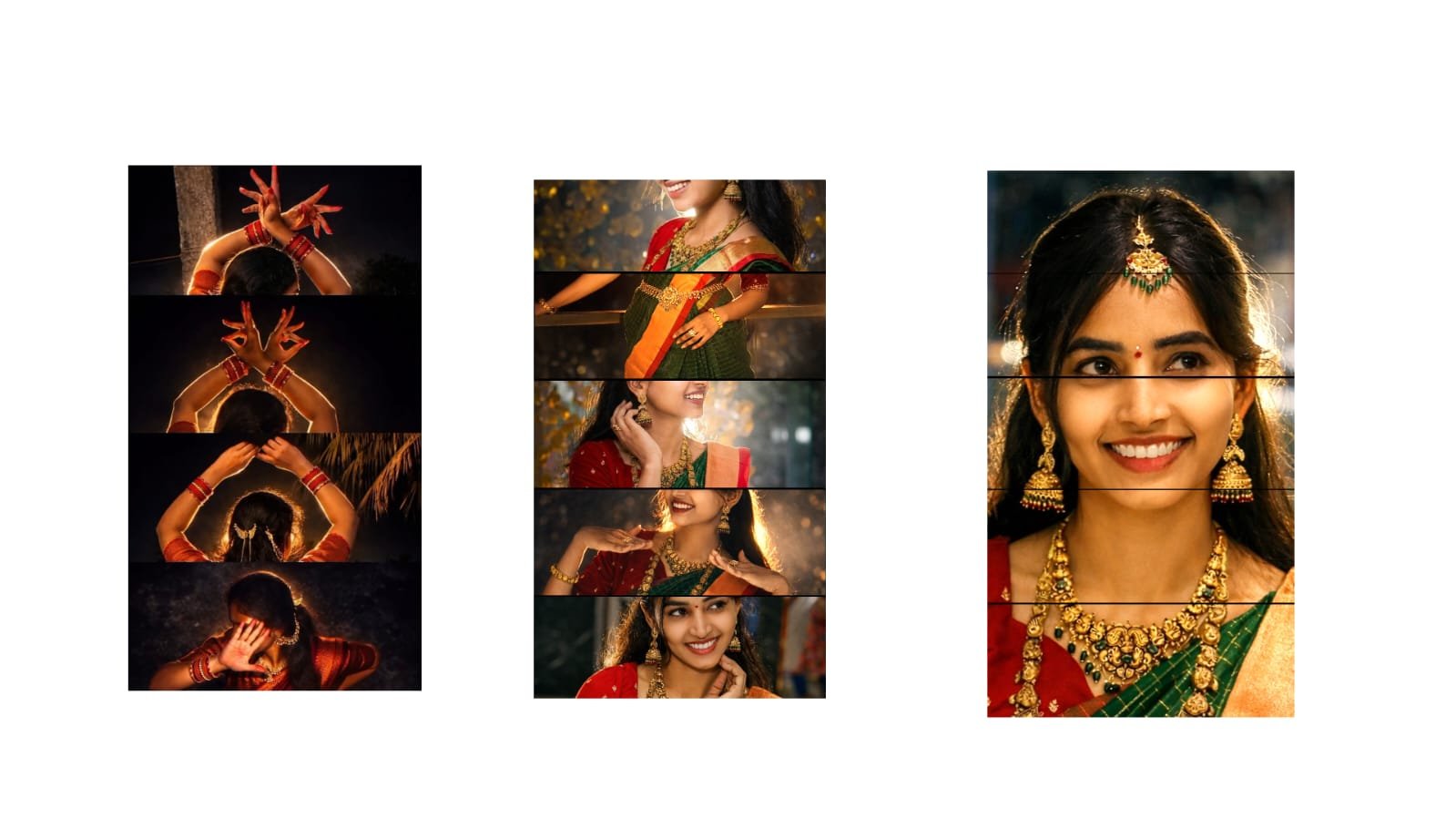

Apply a cinematic night-flash aesthetic while preserving every original detail. Do not alter the subject’s face, hair, identity, pose, framing, lens, or composition. Keep a dark nighttime environment with existing shadows and background intact. Use a strong warm front flash on the face and upper body so the subject is the brightest element. Add high contrast, subtle bloom, light haze, gentle peach skin glow, soft backlit hair strands, and slight foreground depth. Face, hair, pose, and composition must remain 100% identical.

Full project

XML file

download

Song link

download