The Consequences of Not Paying EMIs on Time: Understanding the Implications and Solutions

In today’s world, many individuals rely on loans and credit to meet their personal or business needs. From buying a house or car to funding education or starting a business, loans serve as a useful financial tool. However, loans come with a responsibility—the timely repayment of EMIs (Equated Monthly Installments). Failing to pay EMIs on time can have serious consequences, both financially and legally. This article explores the reasons people face difficulties in repaying EMIs, the consequences of delayed payments, and potential solutions to avoid or mitigate these problems.

Understanding EMIs

Before delving into the issue of delayed EMI payments, it’s essential to understand what EMIs are. An EMI is a fixed payment amount made by a borrower to a lender at a specified date each calendar month. It consists of both principal and interest components, which gradually reduce the outstanding loan balance. EMIs are typically used for personal loans, home loans, car loans, and even some credit card debts. The primary objective behind EMIs is to break down large loan amounts into manageable, smaller payments over time.

Why People Fail to Pay EMIs on Time

There are numerous reasons why individuals might fail to meet their EMI commitments. The reasons range from unexpected financial crises to lack of proper planning. Here are some of the common reasons:

1. Job Loss or Reduced Income: One of the most common reasons for delayed EMI payments is the loss of a job or a significant reduction in income. A person who loses their job or experiences a pay cut may struggle to pay their loans, especially if they have multiple financial commitments.

2. Health Issues: Medical emergencies or prolonged illnesses can significantly disrupt a person’s ability to earn. The cost of healthcare and recovery may leave little money for meeting financial obligations like EMIs.

3. Unforeseen Expenses: Sometimes, unexpected expenses such as home repairs, family emergencies, or accidents can take priority over loan repayments. Individuals may choose to delay EMI payments to manage these urgent expenses.

4. Poor Financial Planning: Lack of proper budgeting or mismanagement of finances can lead to a situation where paying EMIs becomes difficult. Without a financial safety net, unexpected financial burdens can throw a person off track.

5. High Debt-to-Income Ratio: When someone has too many loans or credit obligations, the amount required to service these debts may exceed their monthly income, leaving them unable to make EMI payments on time.

6. Interest Rate Fluctuations: For loans with variable interest rates, a sudden rise in the interest rate can cause the EMI amount to increase, creating an additional financial burden.

The Consequences of Not Paying EMIs on Time

Not paying EMIs on time can lead to a series of financial, legal, and personal repercussions. Some of the immediate and long-term consequences include:

1. Late Fees and Penalties: The most immediate consequence of failing to pay an EMI on time is the late fee or penalty charged by the lender. These charges increase the overall loan amount and can make the debt even more difficult to pay off in the future.

2. Impact on Credit Score: One of the most significant long-term consequences of missing EMI payments is the negative impact on your credit score. Credit bureaus track payment histories and penalize individuals who fail to meet their financial obligations. A lower credit score can make it difficult to secure future loans, credit cards, or even rental agreements.

3. Increased Debt: If EMIs are not paid for an extended period, interest and penalties continue to accumulate. As a result, the overall loan balance increases, making it more difficult to pay off. Eventually, the borrower could find themselves in a debt spiral, where the accumulated debt becomes unmanageable.

Santosh RCF, [2 Dec 2024 at 10:56:14 PM]:

4. Legal Action: If EMI payments continue to be missed, the lender may take legal action. The lender can send collection agencies to recover the debt or even file a lawsuit in court to claim the outstanding amount. This could result in further financial burdens, including court costs and legal fees.

5. Seizure of Assets: In the case of secured loans (e.g., home loans, car loans), failure to repay EMIs can lead to the lender seizing the collateral. If you default on a home loan, for example, the lender could initiate foreclosure proceedings, potentially leaving you homeless.

6. Mental and Emotional Stress: Constantly worrying about missed payments, mounting debt, and possible legal actions can lead to severe mental and emotional stress. This, in turn, can impact your overall well-being, affecting both personal and professional life.

7. Difficulty in Obtaining Future Credit: A history of late EMI payments or loan defaults can make it very difficult to obtain loans or credit in the future. Financial institutions may consider you a high-risk borrower and either reject your applications or charge you higher interest rates on any future loans.

Solutions to Avoid or Mitigate the Impact of Missed EMI Payments

If you are facing difficulties in paying your EMIs on time, it is important to act quickly and explore potential solutions to avoid the negative consequences. Here are a few steps you can take:

1. Communicate with the Lender: If you anticipate difficulty in making an EMI payment, it is crucial to communicate with the lender as soon as possible. Lenders are often willing to offer solutions such as deferred payments, loan restructuring, or an extended repayment period. Timely communication can prevent the situation from escalating.

2. Restructure or Refinance the Loan: If you are facing financial difficulties, you may want to consider restructuring or refinancing your loan. This could involve adjusting the interest rate, extending the repayment period, or consolidating multiple loans into one. While refinancing may increase the total loan term, it could lower the monthly EMI and make it more manageable.

3. Seek Professional Financial Advice: If your financial situation is complicated and you are unsure how to proceed, consulting a financial advisor can help. An advisor can help you create a plan to prioritize essential payments and restructure your debt to avoid defaults.

4. Use Emergency Funds: If you have an emergency fund, now might be the time to dip into it. Emergency funds are designed to help during situations like job loss, medical emergencies, or unforeseen expenses. Using this fund to pay EMIs can help you avoid penalties and negative consequences.

5. Cut Back on Non-Essential Spending: Tightening your budget and cutting back on non-essential expenses can help free up money to pay your EMIs. While it may be challenging in the short term, focusing on essentials like food, utilities, and loan repayments can ensure you don’t fall behind on your obligations.

6. Sell Unnecessary Assets: If you own valuable assets that are not critical to your daily life, such as an extra vehicle or unused property, consider selling them to generate cash to cover your EMIs. While this may not be ideal, it can provide a short-term solution to avoid defaulting.

7. Opt for a Loan Moratorium: In certain situations, such as a medical emergency or natural disaster, banks may offer a temporary moratorium on loan repayments. This option can give you some breathing space, allowing you to recover financially before resuming your EMIs.

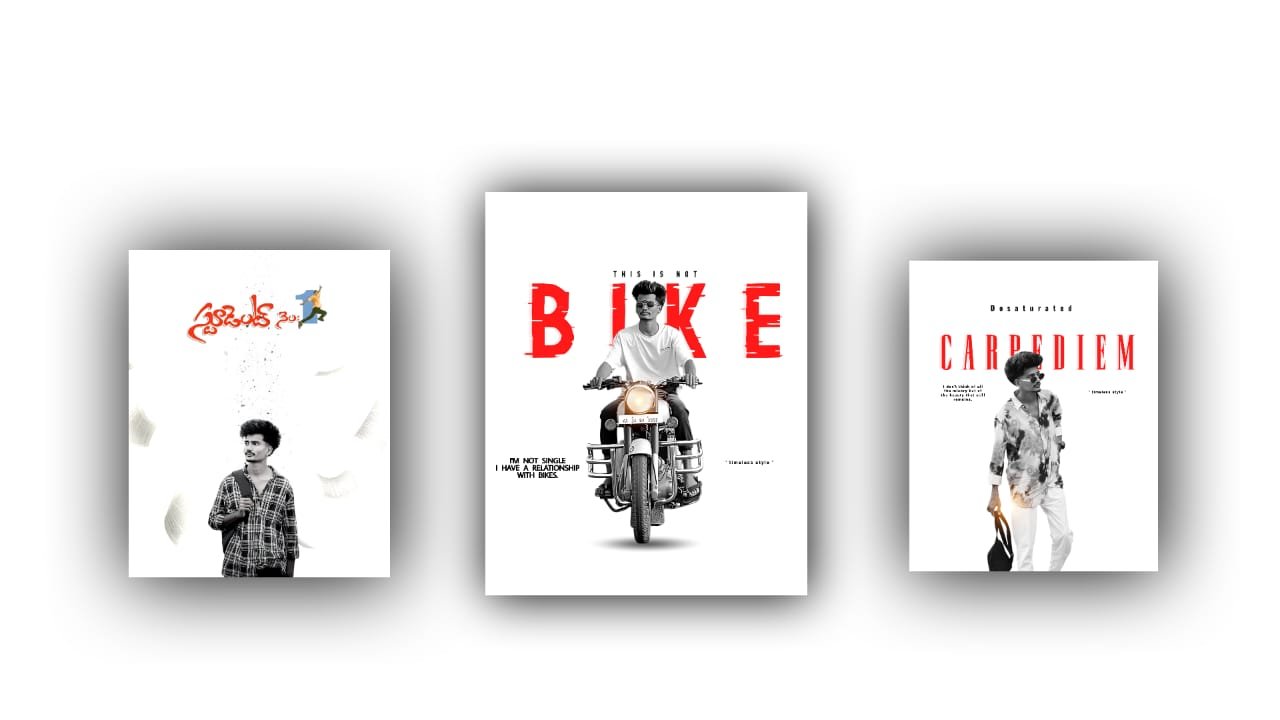

Photo project link

DOWNLOAD

DOWNLOAD

DOWNLOAD

Font

DOWNLOAD