In 2025, digital insurance platforms have become one of the most powerful tools for individuals who want to protect their money, vehicles, health, business, and family assets with maximum transparency and minimum effort, and the shift from offline agents to online insurance systems has completely transformed the experience by offering instant policy comparison, real-time premium calculation, paperless claims, quick verification, and secure digital policy storage that makes managing insurance easier for both beginners and experienced users, and today’s platforms allow people to check multiple insurance plans—health, motor, term, life, travel, accidental, and business insurance—within seconds, helping them understand coverage benefits, add-on options, claim history, network hospitals, and total costs before making a final decision, and this simple comparison feature alone saves users thousands of rupees every year by helping them avoid overpriced or unnecessary plans that offline agents often push without explaining details, and when it comes to motor insurance, digital platforms show users accurate pricing for third-party, comprehensive, zero-depreciation, engine protection, consumables cover, and return-to-invoice add-ons, which allows car or bike owners to select exactly what they need based on daily usage, vehicle cost, city traffic conditions, and risk level, and the biggest advantage

here is complete transparency because users get to see real-time premium breakdown, GST calculation, IDV value, discount availability, and no-claim bonus benefits before paying anything, and for health insurance, digital platforms now come with advanced tools like pre-existing disease coverage checkers, waiting period calculators, hospital locator maps, and medical underwriting assistance that help families choose the most suitable protection for their health needs, especially for people with long-term conditions like blood pressure, diabetes, thyroid issues, asthma, or varicose veins, and these platforms also provide cashless treatment availability information, claim settlement ratio data, and lifetime renewal options that are crucial for selecting long-term health plans, and in addition to this, users can now protect their income with term insurance that guarantees financial stability for family members in case of unexpected events, and digital portals make it easy to compare term insurance policies based on sum assured, rider options, claim success rate, solvency ratio, and premium flexibility, ensuring families always stay protected without confusion, and another major development in 2025 is AI-based risk assessment systems that analyze user profiles and provide personalized insurance recommendations, such as suggesting higher IDV for new cars, advising critical illness cover for families with medical history, or offering accident protection

plans for people who travel long distances daily, and these personalized insights help users avoid under-insurance or over-insurance while ensuring maximum financial protection, and filing claims has also become smoother as digital platforms now support online document upload, instant claim registration, video-based vehicle inspection, cashless claim approval tracking, and doorstep surveyor visits in case of accidents, reducing the time and stress involved in the claim process, and many insurance apps also provide renewal reminders, premium due alerts, claim assistance, emergency helplines, and 24/7 chat support to help users whenever they need guidance, and cybersecurity features like OTP verification, encrypted storage,

secure policy lockers, and fraud detection systems ensure that user data remains safe during online transactions, making digital platforms more reliable and secure than many offline processes, and as government regulations improve, insurance companies are now required to maintain transparency, publish claim ratios publicly, and follow strict customer protection guidelines, which benefit users by eliminating hidden charges, reducing fraudulent practices, and ensuring fair claim processing, and small business owners can also benefit from digital platforms by protecting their shops, offices, equipment, employees, and liabilities through tailor-made business insurance plans that are now easy to buy online with clear documentation and coverage details, and today’s digital insurance ecosystem has made it possible for individuals to protect their vehicles from accidents, their homes from damages, their health from rising hospital

costs, their business from unexpected risks, and their family from financial stress, and the biggest reason for the growth of digital insurance in 2025 is the convenience, clarity, speed, and affordability that these platforms provide, helping users make smarter decisions, save more money, and stay financially secure at every stage of life, and as digital adoption continues to rise, insurance will become even more user-friendly and accessible, giving more people the confidence to stay protected and build a stronger financial future.

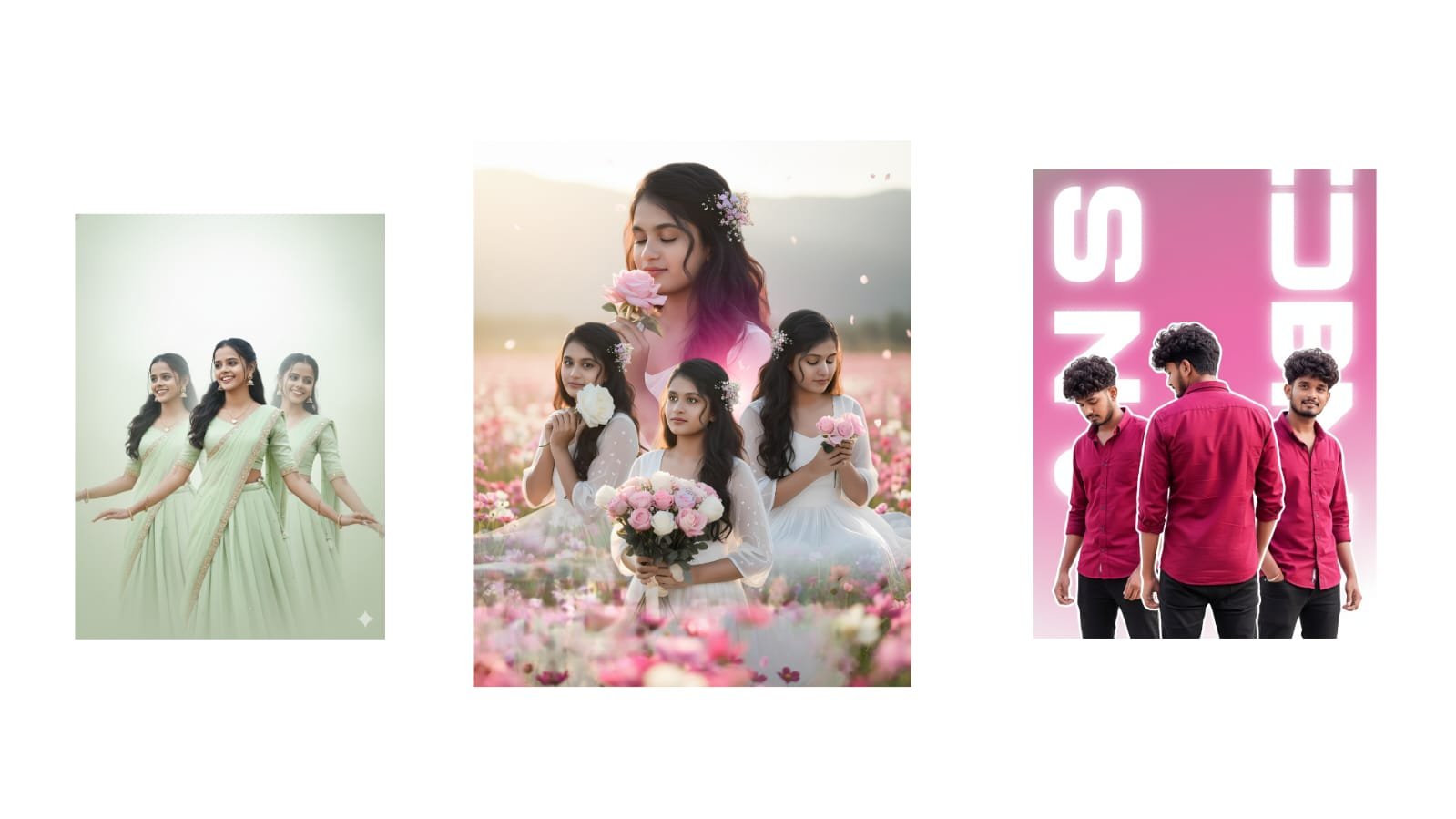

Prompt 1

“A Uploaded image serene, dreamy photoshoot of a young girl in a blooming flower field at golden hour, wearing a flowing white traditional dress. She has long wavy hair decorated with tiny pastel flowers. Capture multiple poses mix photo smelling a pink flower, holding a soft rose near her face, gracefully sitting among flowers, and holding a bouquet of pink and white roses. Soft sunlight creates a warm glow behind her, with mountains in the 1 background and gentle petals floating in the air. Style: cinematic, pastel tones, ultra-soft lighting, high-detail portrait, fantasy atmosphere, shallow depth of field, bokeh, ethereal mood.” face matching

Prompt 2

A soft, dreamy portrait composition featuring a young woman with a warm smile, shown in three overlapping poses. She has long, wavy black hair and wears a light pastel green traditional outfit with subtle embroidery and shimmering details. A small white tilak on her forehead and delicate gold jewelry (earrings and a heart-shaped pendant necklace) add cultural elegance. The background is a smooth gradient of light green and white, creating a serene and ethereal atmosphere. Lighting is gentle and diffused, giving the scene a calm, glowing feel. Ultra-realistic, high-resolution, smooth skin texture, natural expression, cinematic soft focus.

Prompt 3

A uploaded image soft, aesthetic collage-style portrait of a young woman sitting on stairs, with long light-black hair and gentle bangs, eyes closed, smiling softly. She wears a same dress . The collage includes multiple cropped rectangular frames showcasing close-up details of her face, arranged with white borders in a modern editorial layout. Decorative elements such as small white flowers, handwritten text overlays (“choose kindness”, “notes of style”), and magazine-style typography (“, “HEMA”) add a trendy scrapbook vibe. The main portrait is outlined with a hand-cut sticker effect. Soft pastel tones, dreamy lighting, minimal grain, aesthetic Instagram-style edit, fashion editorial mood board, high-resolution.

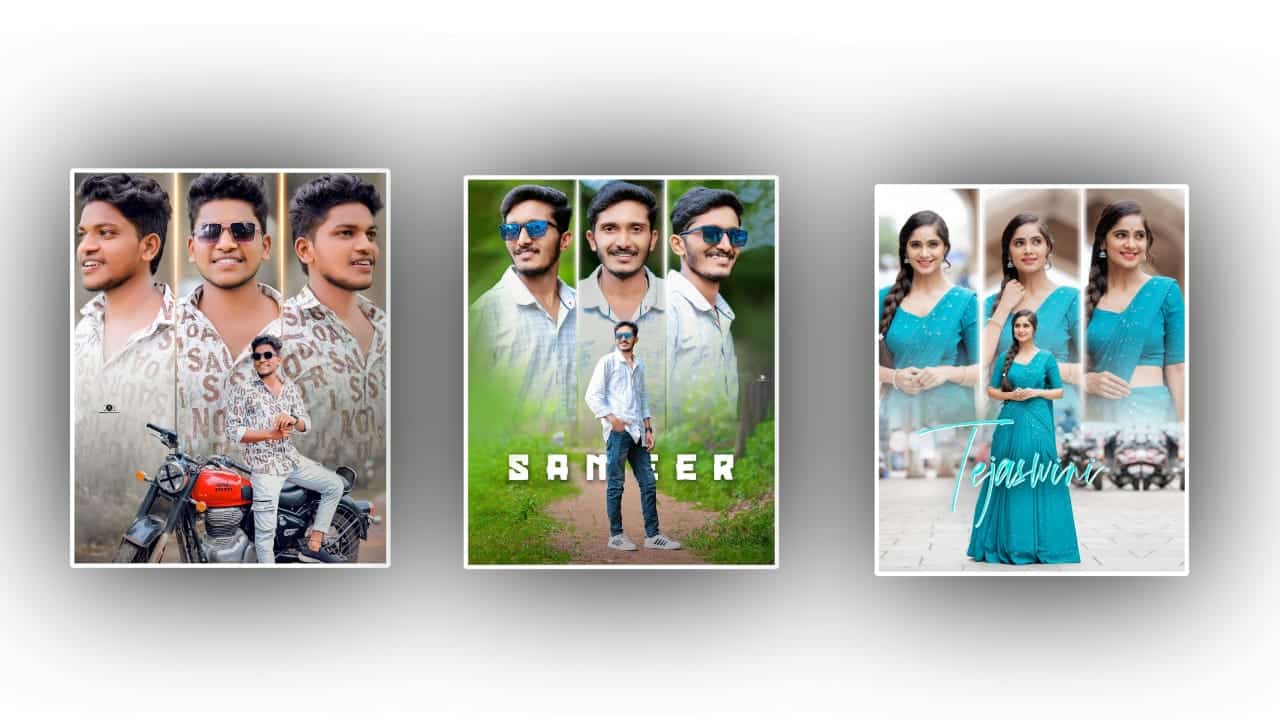

Prompt 4 (BOY)

A image bold, stylish collage composition featuring a young man in three poses, all wearing a bright magenta-red shirt and black pants. The central figure is shown from the back, while the two side figures face forward—one looking down and the other looking at the camera with a soft smile. The background is a smooth gradient of pink and white with a strong neon effect. Behind the subjects, large vertical bold text stretches across the frame, creating a striking graphic design backdrop. Lighting includes subtle glow highlights around the figures for a dramatic, modern poster look. High-resolution, clean cutout edges, vibrant colors, fashion-poster style, dynamic composition, aesthetic Instagram edit.