”

In 2025, banking scams in India have increased rapidly due to the rise of digital payments, UPI transactions, online shopping, loan apps, and mobile banking, making it extremely important for every smartphone user to understand how scams work and how to protect their money from fraud. The biggest banking scams in India 2025 include UPI fraud, KYC update scams, fake customer care calls, loan app harassment, SMS link scams, credit card limit fraud, OTP sharing scams, investment fraud, job-offer scams, and QR-code fraud, each targeting innocent users who may not know the latest digital tricks used by scammers. UPI scams remain the most common in 2025, where fraudsters send fake “Payment Request” links or ask victims to scan a QR code to receive money, causing instant debit from the bank account. KYC update scams also increased massively, where scammers send SMS like “Your bank account will be blocked, click here to update KYC,” leading users to fake banking websites that steal OTP, debit card numbers, and login credentials. Fake customer care scams involve fraudsters pretending to be from SBI, HDFC, or ICICI, convincing users to “verify account details,” and then emptying accounts. Loan app scams continue to trap people by offering instant loans with no documents, then threatening

victims with harassment, contact leaks, and heavy interest penalties. SMS phishing scams send fake messages showing refunds, parcel delivery alerts, electricity bill disconnection, FASTag expiry, or RBI notifications, all containing malicious links. In 2025, a new scam called credit card limit upgrade fraud is rising, where scammers promise to increase card limits and then steal OTPs to make illegal transactions. Another dangerous fraud is remote access scams, where scammers ask users to install apps like AnyDesk or TeamViewer, gaining full control of their phone and banking apps. Investment scams invite people to join Telegram/WhatsApp groups claiming “Earn ₹5000 daily,” “Guaranteed return,” or “Crypto doubling,” but once money is deposited, the scammers disappear. Job scam frauds target youth by offering high-paying “work from home” tasks and demanding registration fees.

To stay safe from banking scams in 2025, users must follow strict digital safety rules. Never click on suspicious links in SMS, WhatsApp, or email—banks never send clickable KYC links. Never share OTP, CVV, debit card PIN, account number, Aadhaar, or PAN with anyone on call. Never scan QR codes to receive money, because QR code scanning only sends money. Always verify customer care numbers through the official bank website or mobile app—never trust numbers found on Google search. Keep your phone locked with biometrics and regularly update UPI apps like GPay, PhonePe, Paytm, and bank apps for maximum security. Users should avoid downloading unknown apps or screen-sharing apps. Banks and RBI have clearly stated: no bank employee will ever ask for OTP, PIN, or password.

To avoid loan app scams, borrow only from RBI-approved NBFCs and banks listed on the official RBI website. Delete shady apps that ask for unnecessary permissions like camera, contacts, and location. For investment safety, only invest through SEBI-regulated apps and avoid Telegram groups promising unrealistic profits. Use strong passwords for banking apps and change them regularly. Turn on UPI device binding for extra security—this ensures your UPI works only on your own phone. If you receive a suspicious call or message, report it immediately to 1930 (Cyber Crime Helpline) or the cybercrime portal.

Overall, in 2025, banking scams have become smarter, but users can stay completely safe by being cautious, avoiding suspicious links, never sharing OTPs, using secure apps, and reporting fraud quickly. With awareness and digital discipline, every Indian can protect their hard-earned money and enjoy safe online banking.

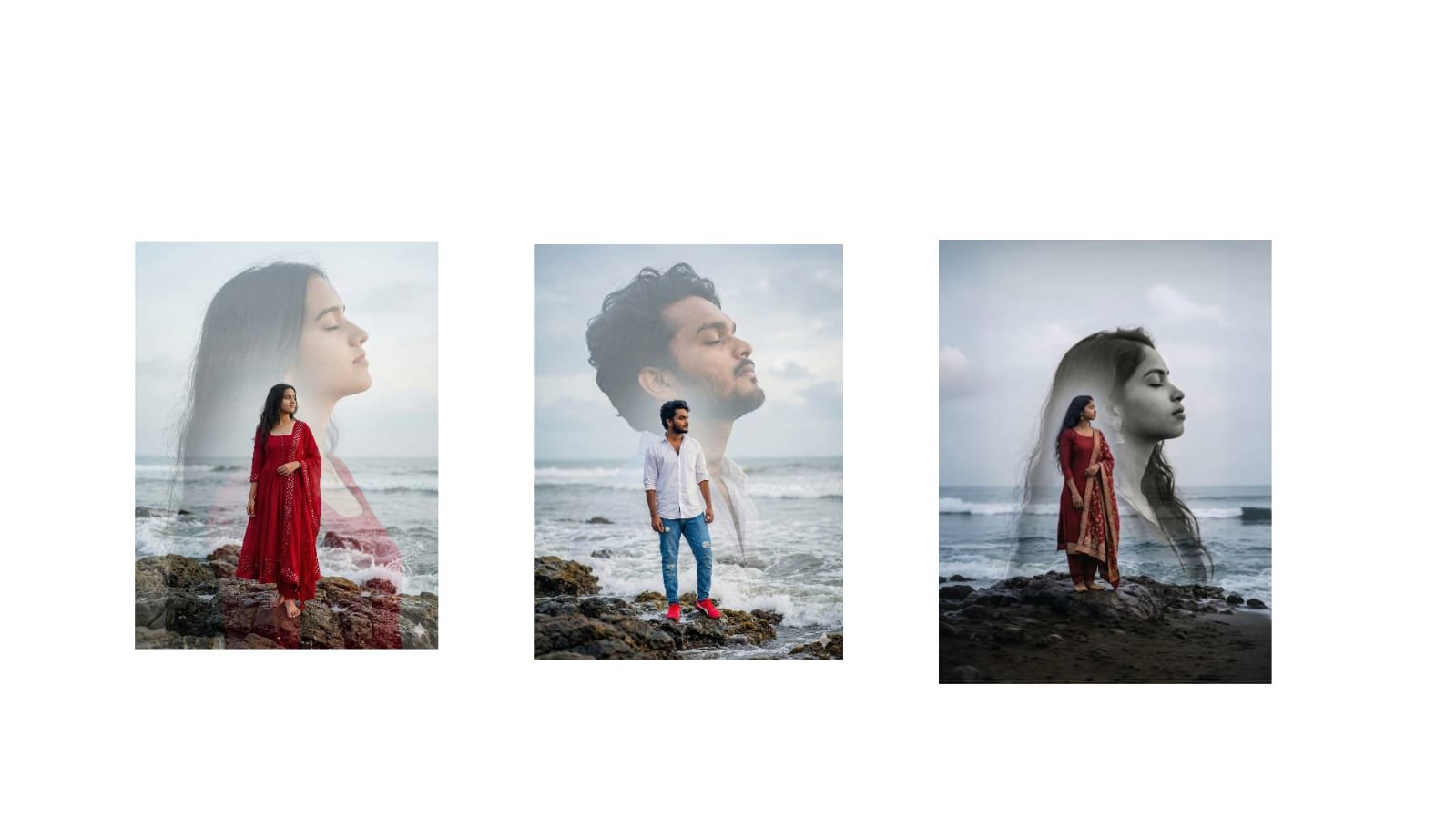

Prompt girl

“A Uploaded image double-exposure portrait of a young woman standing on rocky shore by the ocean. In the foreground, she wears a deep same dress with golden embroidery, looking calmly to the side. Behind her, a large translucent profile of the same woman appears with closed eyes, creating a dreamy, emotional, reflective mood. Soft overcast sky, gentle ocean waves, natural lighting, cinematic tones, artistic composition, high detail, ethereal atmosphere.” person

Prompt 2 boy

“A Uploaded image double-exposure portrait of a young MAN standing on rocky shore by the ocean. In the foreground, she wears a deep same dress with golden embroidery, looking calmly to the side. Behind her, a large translucent profile of the same woman appears with closed eyes, creating a dreamy, emotional, reflective mood. Soft overcast sky, gentle ocean waves, natural lighting, cinematic tones, artistic composition, high detail, ethereal atmosphere.” person (preserve face 100%)