In 2025, business loans in India have become more accessible, faster, and easier to apply for, helping millions of small businesses, startups, shop owners, freelancers, and MSMEs get the funds they need for expansion, working capital, inventory purchase, equipment, renovation, and new projects. The best business loan options in India 2025 include SBI SME Business Loan, HDFC Bank Business Loan, ICICI Bank Business Loan, Axis Bank MSME Loan, Kotak Mahindra Business Loan, IDFC FIRST Business Loan, Bajaj Finserv MSME Loan, Tata Capital Business Loan, LendingKart Business Loan, NeoGrowth Digital Loan, FlexiLoan, Indifi, and Paytm for Business Loan, each offering high loan amounts, fast approval, flexible EMIs, and transparent processing. SBI SME Loan is one of the most trusted business loan products in 2025, offering up to ₹50 lakh with low interest for small shops, traders, and manufacturers, perfect for businesses with steady income. HDFC Bank Business Loan offers instant digital approval, minimal documents, interest from 10.5%,

and quick disbursal, ideal for growing businesses and professionals. ICICI Bank Business Loan is known for its high limits (up to ₹1 crore), flexible repayment, and collateral-free options, making it perfect for service-based and trading businesses. Axis Bank MSME Loan offers fast digital onboarding, GST-based approval, and pre-approved offers for existing customers. Kotak Mahindra Business Loan is popular among startups and freelancers because of its lightweight documentation and quick processing

IDFC FIRST Bank Business Loan has become a top choice in 2025 due to its customer-friendly policies like zero foreclosure charges, fast digital approval, and flexible tenures up to 5 years, making it suitable for growing MSMEs. Bajaj Finserv MSME Loan leads the NBFC segment with loan limits up to ₹75 lakh, zero collateral, instant approval, and Flexi EMI options that help businesses manage cash flow. Tata Capital Business Loan offers easy approval for small enterprises, medical professionals, and retail store owners with attractive interest rates. LendingKart, known for its fast digital processing, offers business loans based on turnover, not credit score alone, making it excellent for small businesses with irregular income. NeoGrowth Digital Loan specializes in loans for businesses that accept digital payments (POS/UPI), allowing them to repay based on daily sales, making it perfect for restaurants, shops, and salons. FlexiLoans and Indifi provide instant online funding for e-commerce sellers, small shops, Kirana stores, and home businesses without heavy paperwork. Paytm Business Loan is ideal for merchants who use Paytm QR and POS, offering loans based on their digital transaction history.

In 2025, government schemes are also helping small businesses grow. PM Mudra Loan (Shishu, Kishore, Tarun) provides collateral-free loans from ₹50,000 to ₹10 lakh for traders, service providers, and small manufacturers. CGTMSE Scheme offers credit guarantee loans for MSMEs without security. Stand-Up India Loan supports women entrepreneurs and SC/ST business owners by offering loans from ₹10 lakh to ₹1 crore. SIDBI MSME Loans continue to support manufacturing units with low-interest funding and refinancing options.

.

To choose the best business loan in 2025, entrepreneurs should compare interest rate, loan amount, processing fee, EMI flexibility, eligibility, and required documents. Banks prefer businesses with ITR, GST returns, bank statements, and stable turnover, while digital lenders give flexibility for small shops without heavy documentation. A good credit score (700+) helps get bigger loans at lower interest, but many NBFC and fintech lenders approve loans based on cash flow and digital payments.

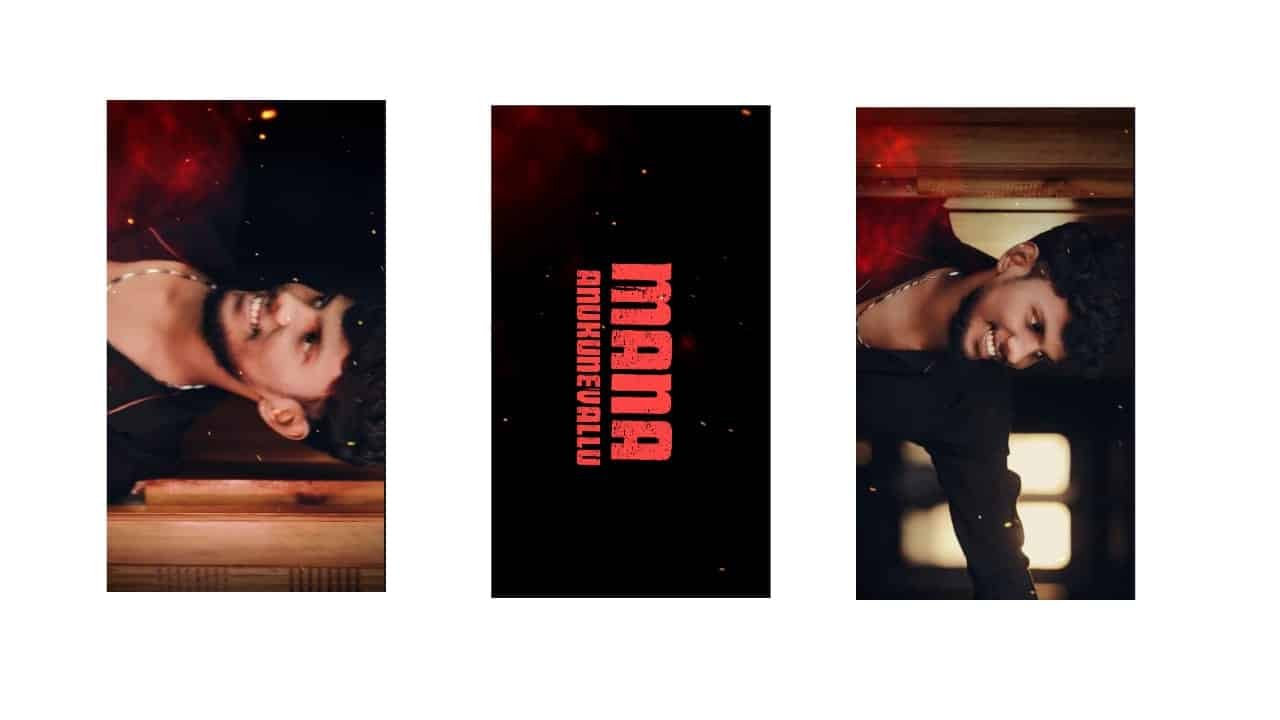

Alight motion

Full project

Download

XML file

Download

Song link ..