Bank account holder insurance has become one of the most valuable yet often unnoticed financial protection benefits offered by modern banking institutions, providing customers with essential coverage against unexpected risks simply by maintaining an active bank account. Many account holders remain unaware that their savings or current accounts may include built-in insurance benefits designed to protect them from financial loss due to accidents, death, or unforeseen emergencies, making this protection an important but underutilized component of financial security. In today’s unpredictable financial environment, unexpected events such as accidents, health emergencies, or sudden loss of income can disrupt financial stability and create significant economic pressure on individuals and their families, and bank account holder insurance helps reduce this risk by offering structured financial support when such situations occur. One of the primary benefits of bank account holder insurance is accidental death coverage, which provides financial compensation to the nominee or family members in the event of the account holder’s death caused by an accident,

ensuring that dependents receive immediate financial assistance to manage essential expenses such as housing, education, and daily living costs. This protection plays a crucial role in supporting family stability during emotionally difficult situations and prevents sudden financial hardship that may arise from loss of income. Another important feature of bank account holder insurance is permanent or partial disability coverage, which provides financial compensation when an account holder suffers injury or disability that affects their ability to work and generate income. This financial assistance helps cover medical treatment expenses, rehabilitation costs, and ongoing living requirements, allowing individuals to maintain financial independence despite physical challenges. Some bank account insurance programs also provide hospitalization benefits, offering reimbursement for medical expenses incurred due to accidents or emergencies, reducing the need to use personal savings or take loans to manage healthcare costs. Accessibility is one of the most significant advantages of bank account holder insurance, as coverage is often provided automatically when customers open specific types of accounts or maintain minimum balance requirements, eliminating complex application procedures or extensive documentation. This convenience encourages wider participation in financial protection programs and ensures that individuals from various income levels receive basic insurance coverage. Another key benefit is cost efficiency, as many banks offer account holder insurance at minimal cost or include it as part of account maintenance benefits, making financial protection affordable and accessible to a broad range of customers

The integration of insurance benefits with everyday banking services also promotes financial inclusion by extending protection to individuals who may not actively purchase separate insurance policies due to lack of awareness or financial constraints. Digital banking technology has further enhanced transparency by allowing customers to review insurance coverage details, update nominee information, and track policy benefits through mobile banking applications or online platforms, improving awareness and simplifying policy management. Bank account holder insurance also strengthens financial confidence by providing customers with additional security for themselves and their families, encouraging responsible financial planning and risk management. Financial institutions design these protection programs to enhance customer trust and promote long-term relationships by offering comprehensive financial services that combine savings, transactions, and risk protection within a single system. Another important advantage of bank account holder insurance is the simplified claim process, as banks often assist customers or beneficiaries in submitting claims and obtaining compensation efficiently according to policy conditions, reducing administrative challenges during difficult times. Regulatory oversight ensures that banks operate under strict compliance standards and collaborate with authorized insurance providers, guaranteeing policy authenticity and reliable claim settlement procedures.

Despite these benefits, customers should carefully review the terms and conditions of account holder insurance, including coverage limits, eligibility criteria, and exclusions, to ensure that the protection provided meets their financial needs and expectations. Understanding policy details helps avoid misunderstandings and ensures that beneficiaries can access financial support without complications when required. Customers should also regularly update nominee details and maintain active account status to ensure continuous coverage and effective financial protection. Financial planning experts emphasize that risk management is a fundamental component of long-term financial stability, and bank account holder insurance supports this principle by providing basic protection against unexpected events that may otherwise disrupt financial progress. Families benefit significantly from this protection as it creates a financial safety net that safeguards household stability and supports dependents during emergencies.

Bank account holder insurance also complements other financial protection tools such as health insurance, life insurance, and savings plans, creating a comprehensive financial security framework that addresses multiple risks simultaneously. Financial stability in today’s dynamic economic environment requires not only earning and saving money but also protecting financial resources against unforeseen circumstances, and bank account holder insurance provides this essential safeguard by delivering accessible and reliable protection. As financial systems continue to evolve and risks become more complex, individuals who understand and utilize bank account holder insurance demonstrate foresight and responsibility

by securing their financial future and protecting their families against uncertainty. Bank account holder insurance therefore represents a powerful financial protection solution that combines affordability, convenience, and reliable coverage, helping individuals maintain financial resilience, protect their loved ones, and build long-term financial security with confidence in an unpredictable world.

PROMPT

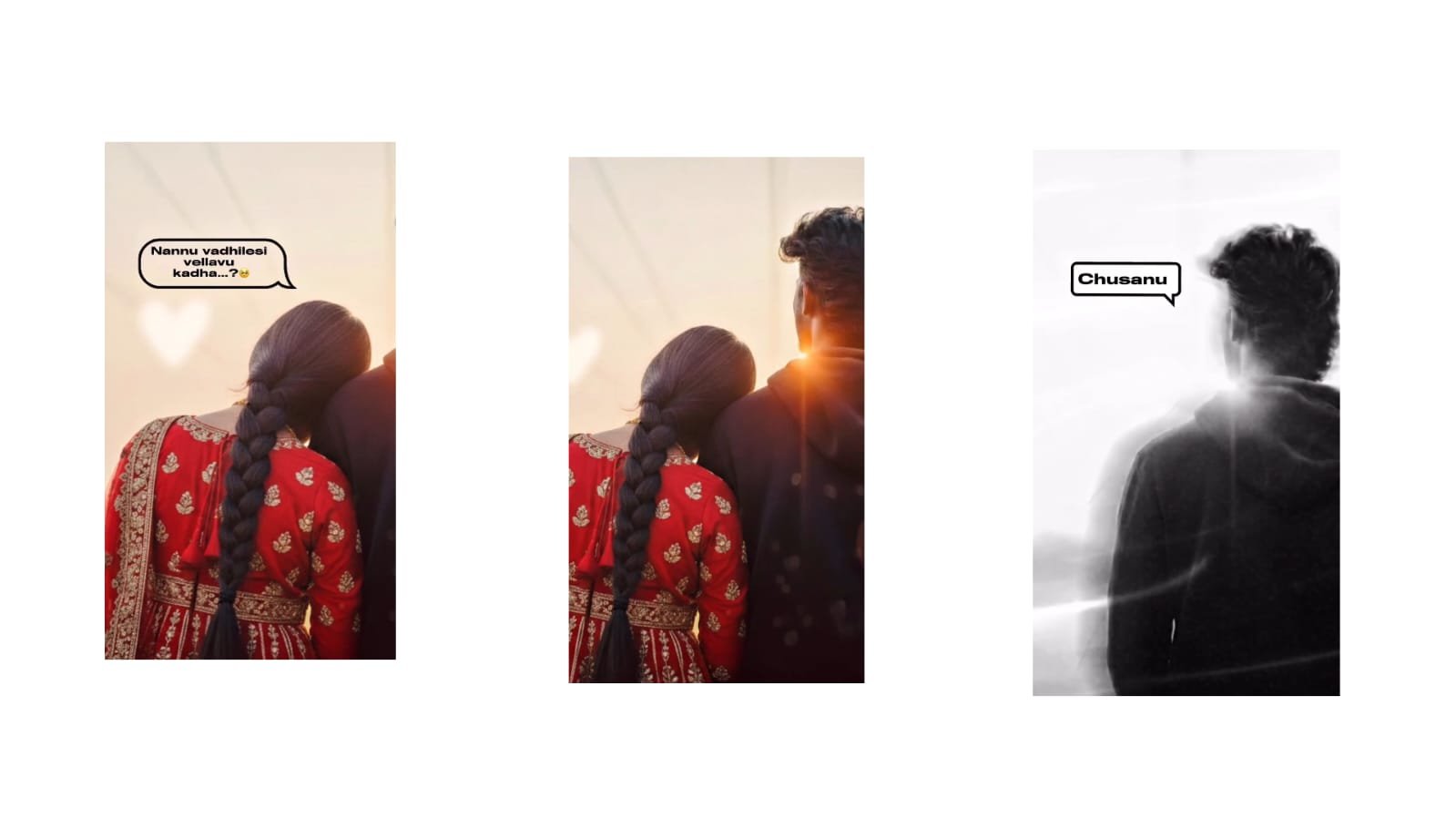

A Uploaded image create romantic cinematic scene of a couple standing close together, viewed from behind, during golden hour. The woman is wearing a same dress outfit with intricate gold patterns and a long thick braided hairstyle falling down her back. She is gently resting her head on the man’s shoulder. The man is wearing a black same dress. Warm sunset light shines between them, creating a soft lens flare and glowing rim light around their silhouettes. The background is minimal and softly blurred with warm pastel tones. Emotional, intimate, peaceful atmosphere, soft focus, shallow depth of field, ultra-realistic, high detail, 4K, cinematic lighting.

Full project

XML file

Song link