Cyber fraud insurance offered through banks has become one of the most essential financial protection solutions in today’s digital banking environment, providing customers with security against increasing online financial risks that threaten personal savings and financial stability. As digital transactions, mobile banking, and online payments continue to grow rapidly, individuals are exposed to various cyber threats such as phishing attacks, identity theft, unauthorized transactions, card cloning, and online banking fraud, which can result in significant financial loss if not properly protected. To address these emerging risks, banks now provide cyber fraud insurance policies that offer financial compensation and protection against losses caused by digital fraud, ensuring that customers can use online banking services with confidence and security. One of the primary benefits of cyber fraud insurance through banks is financial reimbursement for unauthorized transactions,

which protects customers from losing their hard-earned money when fraud occurs despite following security guidelines. This coverage helps individuals recover funds lost due to hacking, phishing, or fraudulent online activities, preventing sudden financial disruption and maintaining financial stability. Another significant advantage of cyber fraud insurance is identity theft protection, which provides financial and legal support when personal information such as banking credentials, identification details, or payment data is misused by fraudsters. Identity theft can lead to severe financial consequences, including unauthorized loans, fraudulent purchases, or account misuse, and insurance coverage helps mitigate these risks by providing assistance in resolving financial damage and restoring financial credibility. Cyber fraud insurance also offers protection for digital payment transactions conducted through mobile banking applications, internet banking platforms, and electronic wallets, ensuring that customers remain protected while using modern financial services. This protection encourages secure adoption of digital payment systems and supports the transition toward cashless financial ecosystems.

Accessibility is one of the key advantages of obtaining cyber fraud insurance through banks, as customers can easily enroll in protection programs through their existing banking relationships, pay affordable premiums through linked accounts, and manage coverage through digital banking platforms without complex procedures. This convenience increases awareness of financial risk management and promotes responsible use of digital financial services. Bank-linked cyber fraud insurance policies often include additional benefits such as coverage for fraudulent ATM withdrawals, debit or credit card misuse, and online shopping fraud, providing comprehensive financial protection against multiple forms of digital risk. Some policies also

offer customer support services that assist in reporting fraud, blocking compromised accounts, and resolving security issues promptly, minimizing financial damage and improving response time during emergencies. Digital banking technology has further enhanced cyber fraud protection by providing real-time transaction alerts, instant card blocking features, and secure authentication methods that work alongside insurance coverage to strengthen overall financial security.

Another important advantage of cyber fraud insurance is financial continuity, as unexpected financial loss due to digital fraud can disrupt personal financial planning, but insurance coverage helps manage such situations without affecting long-term savings or investment goals. The reliability of cyber fraud insurance offered through banks is strengthened by regulatory oversight and partnerships with authorized insurance providers, ensuring policy authenticity, transparent coverage terms, and efficient claim settlement procedures that build customer trust. Cost efficiency also contributes to the growing popularity of cyber fraud insurance, as premiums are typically affordable compared to the potential financial impact of cybercrime, making it a practical investment in financial protection.

Financial experts emphasize that digital financial risks continue to evolve rapidly, and individuals must adopt proactive protection measures rather than relying solely on preventive security practices. Cyber fraud insurance supports this proactive approach by providing a financial safety net that protects customers even when security breaches occur beyond their control.

Families and businesses also benefit from cyber fraud insurance coverage that safeguards financial assets and ensures continuity in financial operations despite digital threats. Customers should nevertheless carefully review policy terms, including coverage limits, reporting timelines, eligibility conditions, and exclusions, to ensure that the selected plan provides adequate protection for their specific financial activities. Understanding policy requirements helps ensure smooth claim processing and maximum benefit from coverage. Regular monitoring of account activity and adherence to banking security guidelines further strengthen protection and reduce exposure to fraud. Cyber fraud insurance also promotes financial awareness by encouraging individuals to recognize digital risks and adopt secure financial practices while using online services.

Financial stability in today’s technology-driven world depends not only on earning and saving money but also on protecting financial assets against evolving cyber threats, and bank-linked cyber fraud insurance provides this essential safeguard by securing digital transactions and protecting customer funds. As online banking continues to expand and cyber risks become more sophisticated, individuals who invest in cyber fraud insurance demonstrate financial awareness and responsibility by protecting their savings and ensuring long-term financial security.

Prompt :- 1

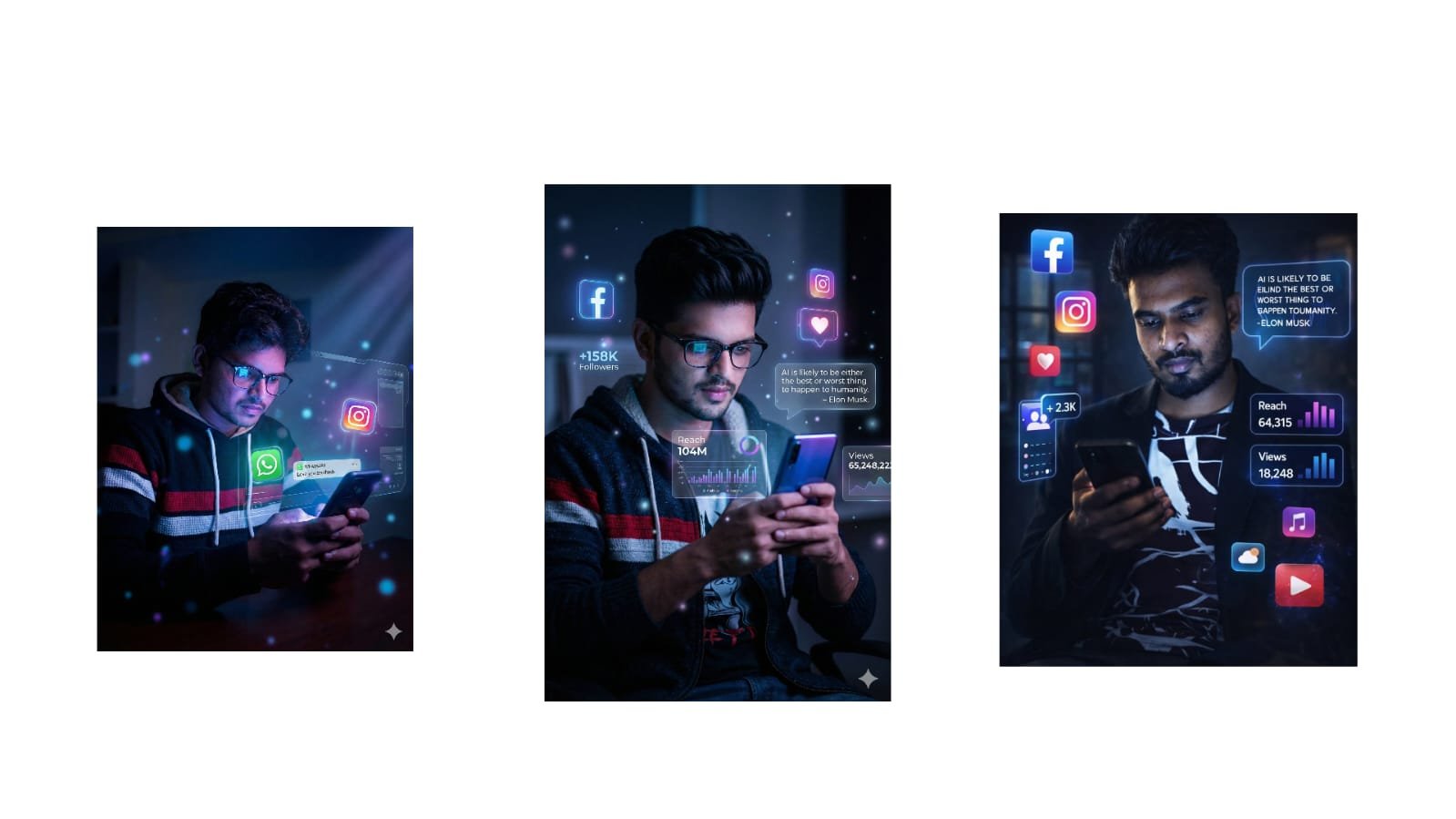

A cinematic portrait of a young man sitting in a dark room at night, illuminated by the glow of his smartphone. He has short styled black hair, trimmed beard, and a focused expression while looking at his phone. He is wearing a black jacket over a graphic t-shirt. The lighting is moody with blue and purple neon tones, high contrast, dramatic shadows. Floating holographic social media interface elements surround him: Facebook icon, Instagram icon, heart/like notification, follower count “+2.3K”, analytics panels showing “Reach 64,315” and “Views 18,248” with bar graphs. A speech bubble with a quote: “AI is likely to be either the best or worst thing to happen to humanity. – Elon Musk.” Add futuristic UI overlays, glowing transparent panels, soft light particles, digital atmosphere, depth of field, ultra-realistic, 4K, sharp focus, cyberpunk-inspired aesthetic, professional photography, volumetric lighting.Prompt 2A Uploaded image create cinematic portrait of a young man sitting in a dark room at night, illuminated by the glow of his smartphone. same hair,, and a focused expression while looking at his phone. He is wearing a same dress over a graphic . The lighting is moody with blue and purple neon tones, high contrast, dramatic shadows. Floating holographic social media interface elements surround him: Facebook icon, Instagram icon, heart/like notification, follower count “+158K”, analytics panels showing “Reach 104M” and “Views 65,24822” with bar graphs. A speech bubble with a quote: “AI is likely to be either the best or worst thing to happen to humanity. – Elon Musk.” Add futuristic UI overlays, glowing transparent panels, soft light particles, digital atmosphere, depth of field, ultra-realistic, 4K, sharp focus, cyberpunk-inspired aesthetic, professional photography, volumetric lighting.