Artificial Intelligence has rapidly emerged as one of the most influential technologies shaping the modern world, and its impact on digital banking and personal finance management is nothing short of revolutionary because banks and financial institutions that once relied on traditional methods are now integrating AI-powered solutions to provide seamless, secure, and personalized services to their customers where one of the key areas of transformation is customer support since AI-driven chatbots and virtual assistants are capable of resolving queries instantly, guiding users through transactions, and even recommending financial products based on spending patterns, making the overall banking experience smoother and more efficient, in addition to this AI is reshaping fraud detection and security as machine learning algorithms continuously analyze transaction data to detect unusual patterns that might indicate fraudulent activities and alert customers in real time, drastically reducing risks compared to manual monitoring, further AI has made financial

planning and wealth management more accessible than ever with robo-advisors that automatically analyze a user’s income, expenses, goals, and risk tolerance to suggest personalized investment strategies that were once limited to high-net-worth individuals with access to private advisors but now available to anyone through mobile apps and online platforms, another significant impact of AI in digital banking is credit scoring where traditional credit models primarily depend on static data such as repayment history and outstanding loans but AI-based models take into account thousands of variables including utility bill payments, online spending behavior, and even smartphone usage patterns to build a more accurate risk profile, thereby enabling banks to extend loans to a larger section of society who were earlier denied credit, apart from banking, AI is revolutionizing personal finance management through budgeting and savings applications that can automatically categorize expenses,

predict upcoming bills, and suggest saving opportunities, for example, some apps now connect to user bank accounts and send real-time notifications like warning if monthly food expenses are exceeding limits or suggesting low-cost alternatives for subscriptions, ensuring that individuals make smarter financial choices, furthermore AI in digital banking has given rise to hyper-personalized marketing where instead of receiving irrelevant promotional emails, customers now get customized offers such as cashback on frequently used services,

reduced interest rates on loans suited to their profile, and insurance recommendations based on lifestyle habits like travel or health data, AI also plays a crucial role in regulatory compliance as financial institutions are subject to stringent regulations but automated systems powered by AI help banks monitor transactions, generate compliance reports, and flag suspicious activities without the need for human intervention, saving time and resources, the technology is also improving user authentication by implementing biometric systems such as facial recognition and voice authentication that go beyond traditional passwords making banking both more secure and convenient, with the rise of mobile-first banking,

AI ensures that even rural and semi-urban populations have access to financial literacy through interactive applications that explain complex concepts in simple language, empowering them to take control of their finances, another breakthrough application is in risk management where predictive analytics helps banks forecast market trends, currency fluctuations, and interest rate changes, allowing both institutions and customers to prepare in advance and minimize losses, moreover AI-driven customer insights are reshaping the insurance sector connected to personal finance because companies now use predictive algorithms to customize premiums based on individual health data gathered through smartwatches or lifestyle tracking apps, ensuring fairness in pricing, as we look to the future AI is set to merge with blockchain and Internet of Things creating even more secure, transparent, and automated ecosystems in digital finance

where payments become faster, fraud nearly impossible, and financial services more inclusive, the rise of voice-enabled banking assistants that allow users to transfer money, check balances, or pay bills simply by speaking will further simplify the way people manage their wealth, and while challenges such as data privacy concerns, algorithmic bias, and regulatory frameworks need careful consideration, the advantages far outweigh the risks making AI a cornerstone of the financial industry’s evolution, therefore for individuals and businesses alike understanding and adapting to AI-driven financial tools is no longer optional but an essential step towards achieving financial growth, security, and smarter decision-making in a world where technology and money are increasingly interconnected.

Font link

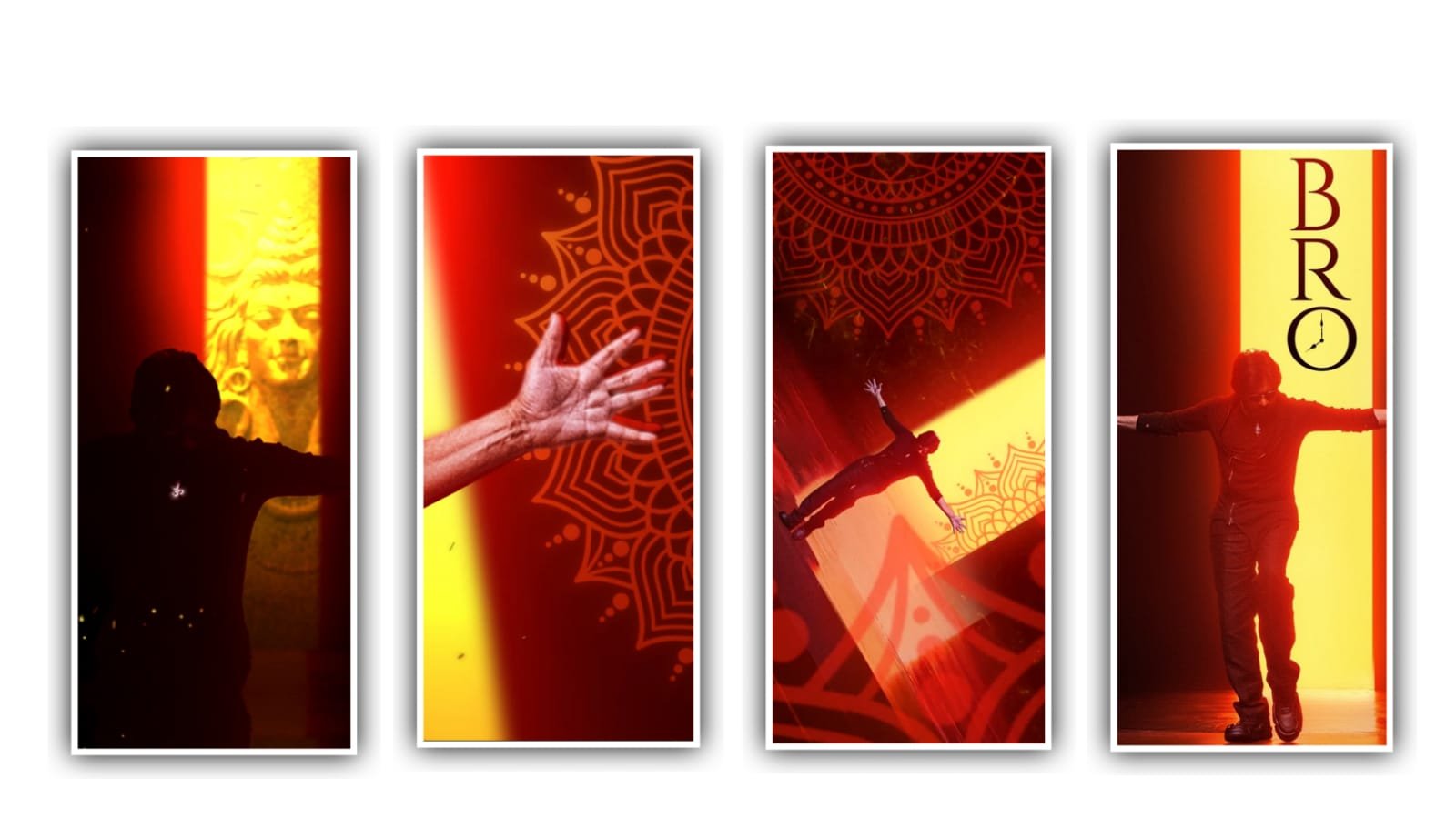

Full project

XML file

DOWNLOAD

Song link