hi friends how are you You have already come to know some of the features of this plan through the below article, you have come to know about the benefits and advantages of this plan and you need to know the complete details of this plan which means you need to make sure about its insurance. The reason why I am saying this is because only in insurance is there a chance to get a good return on your investment. Without further ado let’s go into the details of the policy.

First of all we need to know about the grace period in the policy, the benefit of this is that if you have taken any insurance and you have paid the due amount in one go then you will have a limited period of up to 30 days on the premium. Similarly, if you decide to cancel your policy, you can cancel the policy only after five years as per these premium conditions. Because the insurance of this policy is paid to each and every policy holder if the policy holder surrenders the policy before completion of five years by cancelling the policy, if the protection you get from this insurance policy is definitely stopped by you, the fund value of your fund is definitely transferred to all the funds related to the discontinued policy from time to time.

will be done. Also you through the insurance of this If your policy is not fully renewed again at the time of renewal or within the term, the policy you have opted for will be definitely cancelled. And if you don’t have maturity benefit through insurance then policy cancellation process is also through insurance. Free insurance is provided to you by whoever owns it. This is because the policyholder gets a free look period of three days after receipt of this policy because he or she can cancel his or her promise to the policy and the company bears the risk of anything like medical examination or stand duty charger including expenses. Also whatever you choose you will get more fund value along with the minus on the premium and the customer will receive the premium at the time of need.

Also, you can switch between the entire funds of the three unit linked units of the policyholder at any time during the insurance policy period. Let us know about the features of this plan because if you pay for the first time in this policy you will have the option to renew again from the premium date. Also you will get full coverage in the form of guaranteed protection provided to you at the time of your need. The policy holder has a unique opportunity to reduce the amount through this insurance guarantee in time if you need less protection through this insurance. And of this You will also be subject to certain charges that the policy may charge you at different periods.

After taking the insurance, the premium due is deducted from each hardship without paying the full amount. Because the amount is also reinvested in insurance. Also the policy administration charge of this is taken at the beginning of every month and under the fund management charges you will be charged by the insurer at the rate of 1.35% p.a. Also you get a unique advantage over three unit linked funds while calculating the daily NAV through this insurance. Similarly you must cancel the units from the fund value at the beginning of every month as well so you will definitely get the mortality charges deducted.

Also you will be automatically charged a with the discontinuance charge by this plan at the end of any policy term. Also you will get full other charges in the form of service tax and education cess through this plan, which must be applicable from time to time also on specific notification from your government. Hope you guys will understand the policy details so please support our website for our growth thank you.

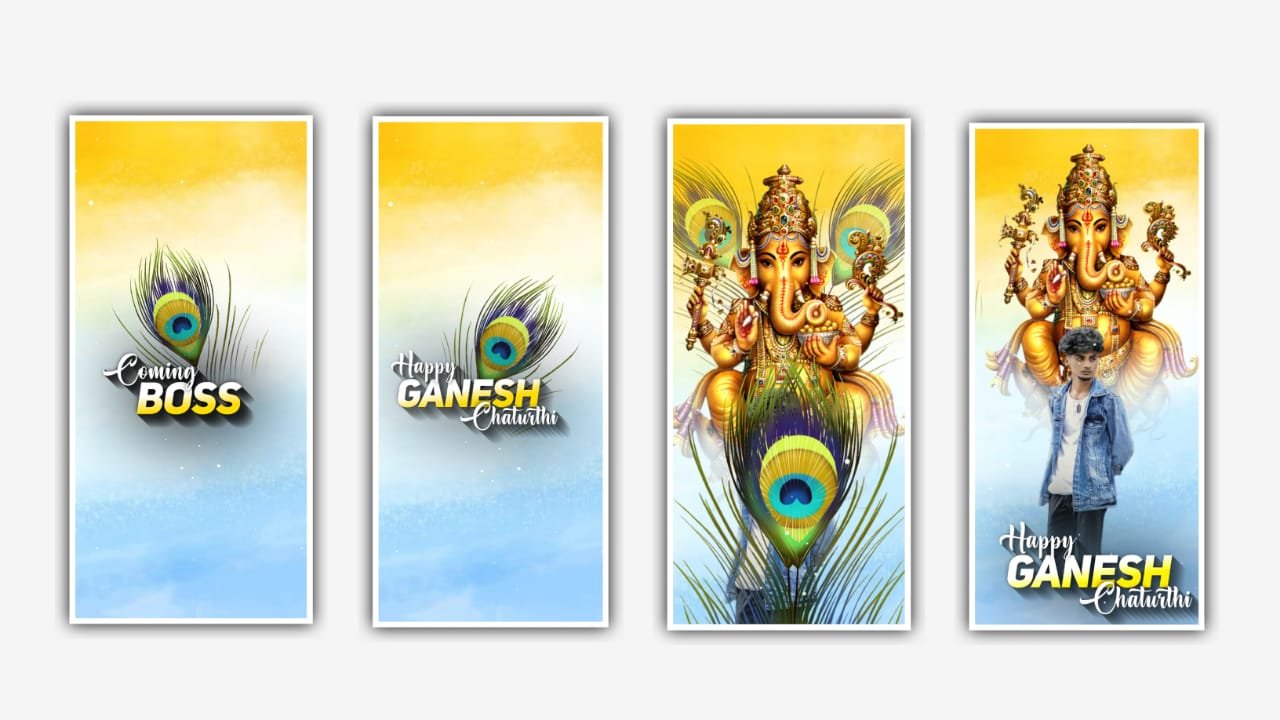

►Kinemaster Preset Link 👇

DOWNLOAD

►Beat Mark project preset :

DOWNLOAD

►Shake effect Preset LINK 👇

DOWNLOAD

►Beat Mark Xml file Link :-

DOWNLOAD

►Shake effect XML LINK 👇

DOWNLOAD

►Video Photo LINK 👇

DOWNLOAD

DOWNLOAD

► Song Download Link 🔗

DOWNLOAD